Loans (US)

MoneyKey Review: Your Financial Solution!

Discover the convenience of online loans with MoneyKey, a hassle-free way to bridge your financial gaps. Find out how their services can provide the support you need!

Advertisement

Navigate financial challenges with ease by choosing installment loans or lines of credit!

In need of quick cash for unexpected expenses? Then prepare to get an inside look on a platform that offers your financial solution. Learn everything about MoneyKey in this complete review!

Whether it’s for home renovations, traveling, or any unexpected expenses, MoneyKey offers different financial solutions catered to different needs. So, keep reading and learn all the features!

- APR: N/A.

- Loan Purpose: MoneyKey’s online loans serve diverse purposes.

- Loan Amount: Online loans ranging from $200 to $3,500.

- Credit Needed: N/A.

- Terms: For installment loans, terms vary from 6 to 12 months. For Lines of Credit, terms are personalized.

- Origination fee: None.

- Late Fee: N/A.

- Early Payoff Penalty: MoneyKey doesn’t charge an early payoff penalty.

MoneyKey: what can you expect?

Get ready to enter the world of MoneyKey online loans and review all the features about their installment loans and Lines of Credit. Then, you can be sure to make an informed financial decision.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Installment loans

Firstly, MoneyKey’s installment loans are considered short-term personal loans and offer a structured repayment plan, allowing you to borrow with confidence.

You can apply online for loan amounts that vary from $200 to $2,500. Then, if you are approved, you can expect the loan amount to be swiftly deposited into your bank account.

Moreover, the flexibility of installment loans shines through in the varying repayment terms, spanning from 6 to 12 months, depending on your state of residence.

Lines of Credit

If you’re looking for an open-ended borrowing solution, then keep reading this review of MoneyKey’s Lines of Credit that will redefine financial flexibility.

Unlike traditional payday or installment loans, a Line of Credit remains active even after you’ve paid it down to a zero balance.

Besides, the personalized terms of a Line of Credit empower you to draw the entire amount or smaller portions over time, ensuring you have access to funds when needed.

Moreover, interest and/or fees are charged only on the amount you use, not your entire credit limit. This provides a cost-effective approach to managing unexpected day-to-day expenses.

With the MoneyKey Line of Credit and the CC Flow Line of Credit, offered in collaboration with CC Flow, you gain a valuable financial tool for handling unexpected costs.

Do the pros outweigh the cons?

For a complete review of MoneyKey, you should also review the advantages and weigh the cons in order to make an informed financial decision. This will shed light on the intricacies of its financial solutions.

Pros

- Offers adaptable repayment structures;

- Quick access to approved funds;

- Wide range of loan options;

- Convenient online application process;

- Transparent terms and customer service.

Cons

- Variable APR may be high;

- Services vary by state;

- Limiting borrowing amounts.

What are the eligibility requirements?

So, applicants for MoneyKey online loans must review eligibility criteria to make sure they fit the requirements. Firstly, applicants should be of legal age to contract in their state of residence.

Besides, they must be either U.S. citizens or permanent residents and reside in a state where the specific product is offered.

Additionally, applicants need to have an active bank account and a regular source of income.

Learn how to request MoneyKey

While the application process for MoneyKey is very simple, below you’ll find a complete step-by-step to review. This will ensure you apply for their online loans smoothly and get the money quickly!

Learn how to request online

The MoneyKey application process prioritizes convenience and efficiency! Check out below a complete guide.

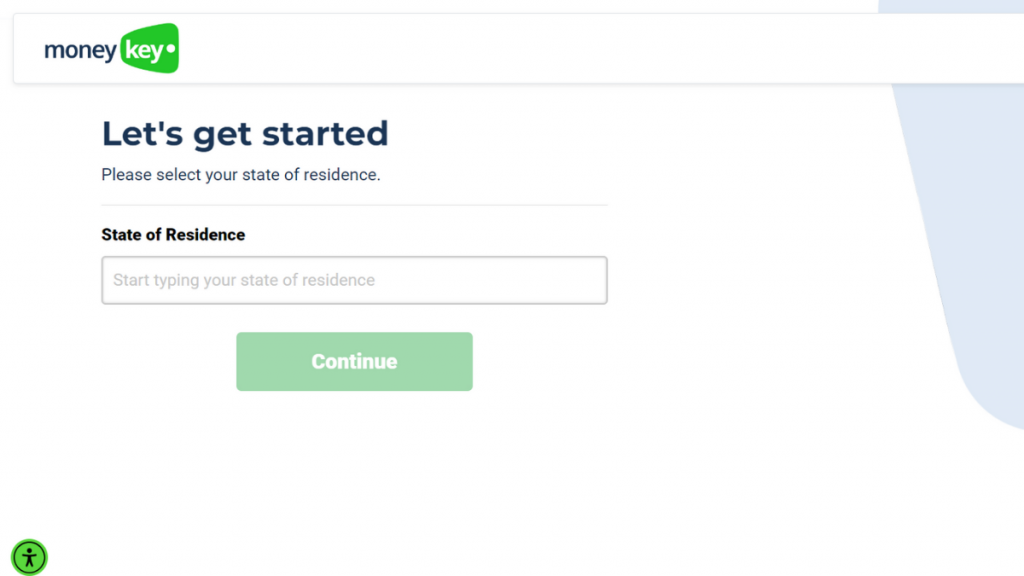

- Access the MoneyKey website: Firstly, visit the official website. Then, click on the option titled “Loans” on the top menu. Next, select the loan you need, installment loan or Line of Credit.

- Start application process: Initiate the online application process by clicking on the “Get Started” button on top of the page. This will direct you to the application form.

- Fill out the form: Complete the application form by providing accurate and detailed information. You’ll likely need to input personal details, financial information, and other relevant data.

- Submit and wait for approval: Depending on the loan type and your specific circumstances, MoneyKey may require supporting documents. When you’re done, submit the form and wait for approval. If approved, you’ll receive an offer.

- Accept offer: Finally, review your offer and accept the terms if they align with your financial goals. Then, funds will be deposited into your active bank account.

What about another recommendation: Rise Credit!

Still not sure about MoneyKey online loans? Then review the Rise Credit platform, a compelling alternative to MoneyKey. If you’re looking for transparent terms, this might be a good choice!

Rise Credit specializes in installment loans, providing a straightforward borrowing experience with flexibility in repayment. Curious to learn how it works and how to apply? Then click the link below!

Rise Credit Review: Smart Financial Choice!

Get access to flexible payment options and review tools to improve your credit with Rise Credit. Enjoy a 5-day risk-free guarantee!

Trending Topics

Tips for job searching: make this task more effective!

Get ready to land your dream job! Learn the best tips and strategies for successful job searching in this comprehensive guide.

Keep Reading

What is Tribel? Is it a worthy alternative to Twitter?

Learn about the features and benefits of Tribel, the social media platform that is changing how people connect and share.

Keep Reading

Walmart MoneyCard Review: Manage Your Money Hassle-free!

Discover the convenience of the Walmart MoneyCard in this review. Enjoy cashback rewards, overdraft protection, and early direct deposit.

Keep ReadingYou may also like

What is an auto loan: everything you need to know before buying a car

Cars can be expensive, but that doesn’t mean you can’t get one. Learning what an auto loan is will help make that big purchase.

Keep Reading

BeReal: the new social media app to counter Instagram

BeReal is a photo-sharing app with a new take on how people post and use social media, and more and more users are flocking to it.

Keep Reading

Barnes Noble Mastercard® full review: points on all purchases at no annual fee

Check out The Barnes & Noble Mastercard® review post and learn how this credit card might be your next tool to earn points at no annual fee!

Keep Reading