Loans (US)

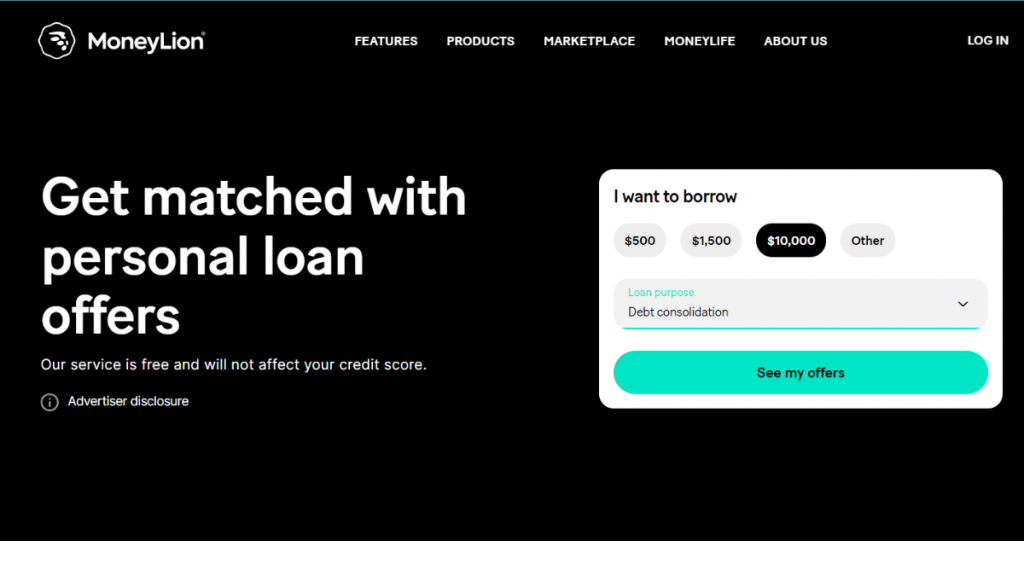

MoneyLion Loans review: Is It the Right Financial Product for You?

Is MoneyLion Loans the right choice for your financial needs? Our in-depth review provides all the details you need to make an informed decision. Understand the features, benefits, and potential drawbacks of this lending service.

Advertisement

Get an insider’s take on MoneyLion Loans, covering features, mobile banking, and unique perks!

This comprehensive MoneyLion Loans review is your gateway to understanding the ins and outs of this amazing platform. So, get the knowledge to make informed decisions about your financial journey!

MoneyLion Loans offer a diverse range of benefits, as you’ll see in this review. From competitive interest rates to a streamlined application process that often results in swift approvals!

But, as with any financial product, there are considerations to keep in mind. So, explore the dynamic world of MoneyLion Loans, providing you with the insights you need to unlock your financial potential.

- APR: MoneyLion offers a competitive APR range for their personal loans, typically spanning from 5.99% to 29.99%.

- Loan Purpose: MoneyLion’s personal loans are versatile and can be used for a variety of purposes, such as consolidating debt, home improvements, covering unforeseen expenses, or pursuing other financial needs.

- Loan Amount: MoneyLion typically provides personal loans ranging up to $1,000.

- Credit Needed: MoneyLion adopts an inclusive approach, catering to individuals with diverse credit profiles.

- Terms: N/A.

- Origination fee: MoneyLion’s lending approach is borrower-friendly as they do not burden you with an origination fee.

- Late Fee: N/A.

- Early Payoff Penalty: Typically, MoneyLion encourages early loan repayment without penalties, which can save you on interest costs.

MoneyLion Loans: what can you expect?

MoneyLion loans operate as a versatile and user-friendly financial solution designed to cater to a variety of needs. It simplifies the loan application process, making it accessible to a wide range of borrowers.

One of the standout features of MoneyLion loans is the competitive interest rates they offer. Besides, they deliver a quick and efficient approval process. In many cases, you receive a decision within minutes!

In addition, you can opt for a repayment schedule that aligns with your financial situation and goals. This adaptability makes MoneyLion loans suitable for various purposes!

Moreover, MoneyLion is not solely a lending platform. It offers an all-in-one financial ecosystem, which includes credit-building tools, investment opportunities, a mobile banking app, and more.

In essence, in this review, you’ll see how MoneyLion Loans offer a user-friendly and comprehensive lending solution with competitive rates, quick approvals, and flexibility in terms.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

As we delve into this MoneyLion Loans review, you can explore the pros and cons of this financial offer. From competitive interest rates to potential drawbacks, unravel the intricacies of MoneyLion!

This way, you’ll equip yourself with the knowledge to make informed decisions about your financial future. So, keep reading to see if this is the right tool for you!

Pros

- Quick approval;

- Competitive interest rates;

- Flexible repayment terms;

- All-in-one financial platform;

- User-friendly mobile app.

Cons

- Limited availability;

- Monthly membership fee;

- Credit inquiry impact.

What are the eligibility requirements?

So, to use MoneyLion’s services, you should typically be at least 18 years old, a U.S. resident, and have a valid Social Security Number, along with a stable source of income.

Besides, for some financial products, MoneyLion may conduct a credit check to assess your creditworthiness, with specific credit score requirements varying based on the product.

Learn how to request MoneyLion Loans

Whether you’re faced with unexpected expenses, aspire to consolidate debt, or have a special project in mind, MoneyLion’s loan services offer a gateway to fulfilling your financial aspirations!

Learn how to request online

Now that you understand how MoneyLion Loans work in the review, it’s time to see how to request a loan online using your smartphone.

- Create an account: If you don’t already have one, start by creating an account with MoneyLion. You can do this by visiting the MoneyLion website or by downloading their mobile app from your device’s app store.

- Eligibility check: Moreover, on your account dashboard, you’ll typically find an option to check your loan eligibility. MoneyLion will request some basic information to determine if you meet the criteria for a loan.

- Complete application: If you’re eligible, proceed to complete the loan application. This entails providing personal and financial details, such as your income, employment information, and the loan amount you wish to request.

- Await approval: Then, MoneyLion’s efficient system will swiftly review your application, and you can typically expect an approval or denial decision within a matter of minutes.

- Funds disbursement: Upon approval, MoneyLion will disburse the loan funds directly into your linked bank account, generally within a few business days.

What about another recommendation: LendingPoint Personal Loan

While MoneyLion Loans offer competitive rates, quick approval, and flexibility, sometimes it’s valuable to explore and review alternatives. Consider LendingPoint Personal Loan!

Indeed, it offers numerous benefits, higher loan amounts, and repayment flexibility! Do you want to know more details? Then don’t miss our following article! Read on and learn more!

How to apply for LendingPoint Personal Loan

Learn how simple and quick it is to apply for the LendingPoint Personal Loan and get the money you need at competitive rates.

Trending Topics

Achieve Financial Freedom: Top Apps for Building Wealth

Stop relying on paychecks alone. Learn the apps and strategies you need to build wealth and achieve financial freedom today. Get started now!

Keep Reading

Discover It® Secured Credit Card review: A card that rewards your spending!

Learn in this Discover It® Secured review why this credit card might be what you need to build your credit while earning rewards.

Keep Reading

Does having a savings account make you a “loser”?

With the current state of inflation, should you keep a savings account or start investing your money to have better returns? Read on for more

Keep ReadingYou may also like

NetFirst Platinum review: $750 line of credit

This card offers a line of credit that allows you to shop without checking your credit history. Check out our NetFirst Platinum review.

Keep Reading

The iOS 16 update will bring a host of new features

Apple enthusiasts will love the new iOS 16 software update. Set for release in September, the upgrade will introduce amazing new features.

Keep Reading

See how to apply for the Bank of Queensland Low Rate Credit Card

Discover how you can easily and quickly apply for a Bank of Queensland Low Rate Credit Card with this step-by-step guide!

Keep Reading