Credit Cards (US)

Navy Federal Visa Signature® Flagship Rewards Review: Earn points

The credit card for savvy travelers is the Navy Federal Visa Signature® Flagship Rewards! You can earn points, skip fees, and enjoy perks. Ready to unlock a world of benefits?

Advertisement

Get ready to earn big on travel and everyday spending! This card brings you benefits, points, and more!

Whether you’re a seasoned globe-trotter or a rewards enthusiast. Now’s the moment to review the benefits that the Navy Federal Visa Signature® Flagship Rewards card has in store!

This credit card is your passport to maximizing the benefits of your spending. So join us on a journey to explore the features, advantages, and experiences that set this card apart from the rest.

- Credit Score: Good to excellent credit score.

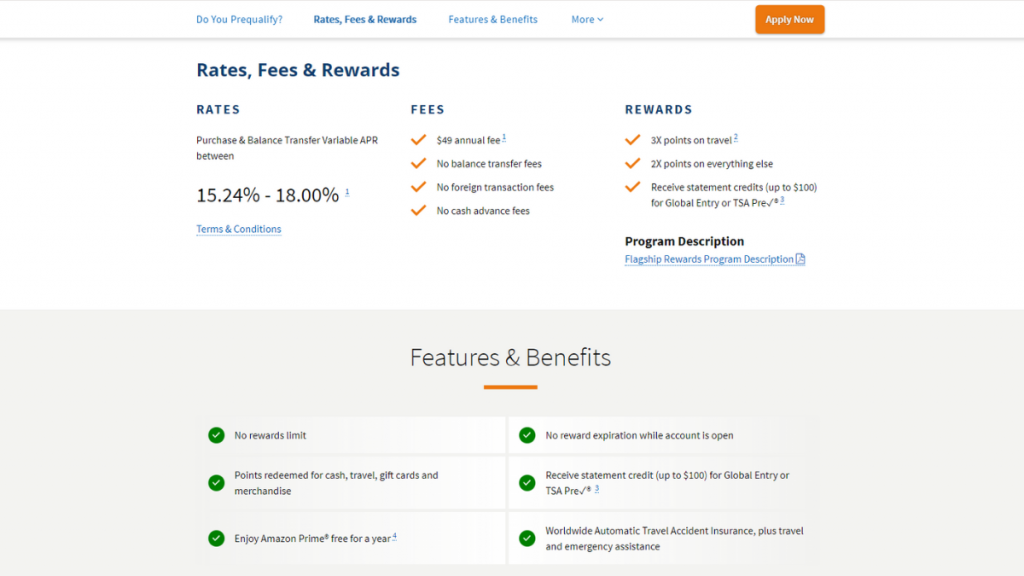

- Annual Fee: The card’s annual cost is a budget-friendly $49.

- Intro offer: Fresh cardholders are greeted with open arms and ushered in by an enticing welcome gesture. A remarkable opportunity to secure 30,000 bonus points when they achieve a spending milestone of $3,000.

- Rewards: Unlock rewards as you earn 3X points on your adventures and 2x points on all your other transactions. These versatile points can be transformed into cash, used for travel adventures, exchanged for gift cards, or indulged in merchandise.

- APRs: The variable annual percentage rate for both purchases and balance transfers falls within a range of 15.24% to 18.00%.

- Other Fees: N/A.

Navy Federal Visa Signature® Flagship Rewards: What can you expect?

In the expansive world of credit cards, the Navy Federal Visa Signature® Flagship Rewards card stands out as a resplendent gem, offering a palette of benefits awaiting your review.

Nevertheless, it’s important to note that this credit card is crafted for those individuals who have maintained very good to exceptional credit histories.

Unlock the charm of triple points on your voyages while doubling the rewards on all your other financial adventures.

This feature empowers you to optimize your rewards, whether you’re navigating your everyday expenses or embarking on grand globetrotting escapades.

Moreover, the card offers a year of Amazon Prime on the house, delivering exclusive deals.

In essence, this is a versatile and rewarding option for those with a penchant for travel, excellent credit, and a desire to maximize their spending potential.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Firstly, this credit card presents cardholders with a unique blend of advantages, from a generous introductory offer to travel perks. But like any financial tool, it’s not without its caveats.

Therefore, to equip yourself with the essential insights, pause for a moment to review the advantages and downsides of the Navy Federal Visa Signature® Flagship Rewards credit card!

Pros

- Remarkable rewards program that sets it apart;

- A warm welcome with a generous bonus;

- Freedom from foreign transaction charges;

- Amazon Prime perks;

- Benefit from travel support and emergency assistance services.

Cons

- A competitive $49 annual fee;

- High credit score;

- Variable APR.

What are the eligibility requirements?

So, Membership with the Navy Federal Credit Union is a mandatory requirement to apply for the card. Membership is primarily open to active-duty and retired military personnel, veterans, DoD employees, and their families.

Additionally, you need to be at least 18 years of age, along with being either a U.S. citizen or a U.S. resident possessing a valid Social Security number, to meet the card’s eligibility requirements.

Learn how to get the Navy Federal Visa Signature® Flagship Rewards

Moreover, after delving into this comprehensive review, you’re eager to harness the advantages presented by the Navy Federal Visa Signature® Flagship Rewards card, check out below how to do it!

Apply online

Applying for this premium credit card is a straightforward but pivotal journey that can open the door to rewarding adventures and financial flexibility!

- Access the Navy Federal website: Head over to the official Navy Federal Credit Union website, and look for the “Loans & Credit Cards” section. Click to see all the credit cards available.

- Navigate the section: Once you’ve landed on the designated page, scroll down to pinpoint the Navy Federal Visa Signature® Flagship Rewards card and effortlessly click to plunge into an in-depth review.

- Start your application: Then click on the “Apply Now” button to initiate the application process. Complete the mandatory fields with precise and current information.

- Submit your application: When you’re done, submit your application and wait for a response from Navy Federal.

- Approval: If you’re approved, you’ll receive your credit card in the mail!

What about a similar credit card? Check out the Royal Caribbean® Visa Signature® Credit Card!

If, after exploring this review of the Navy Federal Visa Signature® Flagship Rewards, you discover a desire for different travel perks offered by a credit card, turn your attention to the Royal Caribbean® Visa Signature®!

You have the opportunity to amass MyCruiseSM points on each and every purchase, extending you the freedom to trade them for memorable experiences with:

- Royal Caribbean International;

- Celebrity Cruises;

- Azamara Club Cruises®.

So whether you’re dreaming of your next cruise adventure or seeking a novel credit card experience, this alternative offers a fresh perspective. Further, check out the full review by clicking below!

How to apply for the Royal Caribbean® Visa card?

Looking for exclusive rewards when you book a cruise? Learn how to apply for the Royal Caribbean® Visa Signature® and earn bonus points!

Trending Topics

What animals make funny noises?

Laugh at the weird and wacky noises that different animals make - from lions to crickets, these animals make funny sounds!

Keep Reading

What are the best foods for brain health?

Learn what are the best foods for good brain health to include in your diet that will improve your memory, reduce stress and more!

Keep Reading

What are the best and worst foods for your mental health?

Learn about the best and worst foods for your mental health, including how they affect your mood, energy, and overall well-being.

Keep ReadingYou may also like

Discover it® Chrome Credit Card review

Find out if the Discover it® Chrome Credit Card is right for you with our in-depth review of its benefits and reward programs.

Keep Reading

See how to apply for the Ink Business Premier℠ Credit Card

Learn how to apply for the Ink Business Premier℠ Credit Card. This guide covers all benefits, eligibility requirements, and more.

Keep Reading

Best Egg Personal Loan review: Low APR rates!

Learn everything you need to know about the Best Egg Personal Loan in this comprehensive review. Find out if this lender is right for you!

Keep Reading