Loans (US)

OppLoans Review: Your Guide to Making Informed Financial Decisions

Experience a better way to borrow with OppLoans. Your trusted source for responsible personal loans. Uncover the path to financial freedom and learn how to secure your future today.

Advertisement

Get the financial support you deserve with safe and affordable personal loans!

Embark on a comprehensive OppLoans review, delving into the intricacies of personal lending with a focus on the unique features and benefits provided by this esteemed online financial institution.

OppLoans offers a pathway to financial stability, even for those with less-than-perfect credit. So, uncover how OppLoans’ accessible eligibility criteria make them a compelling choice for borrowers.

Whether you’re looking to consolidate debt, cover unexpected expenses, embark on home improvements, or address educational needs, OppLoans is here to lend a hand.

- APR: Up to 160%.

- Loan Purpose: OppLoans personal loans can be used for various purposes, including consolidating high-interest debts, covering unexpected expenses like medical bills or car repairs, funding home improvements, or even addressing educational expenses.

- Loan Amount: The loan amounts available through OppLoans typically range from $500 to $4,000.

- Credit Needed: While OppLoans welcomes individuals with diverse credit profiles, they do consider credit history during the application process. Even if you have less-than-perfect credit, you can still be eligible for a loan.

- Terms: OppLoans offers flexible repayment terms, allowing borrowers to choose from a range of term lengths that suit their financial needs. Terms vary by state, ensuring options that align with your situation.

- Origination fee: None.

- Late Fee: N/A.

- Early Payoff Penalty: None.

OppLoans: what can you expect?

OppLoans is your gateway to responsible and reliable personal lending. When you turn to OppLoans, you can expect several key elements that set them apart in the world of online lending.

In this OppLoans review, we highlight the lender’s role in financial empowerment. Firstly, OppLoans prioritizes accessibility. So, their eligibility criteria are designed to welcome individuals with diverse credit profiles.

Secondly, OppLoans places a strong emphasis on transparency. They want borrowers to have a clear understanding of their financial obligations, which is why they provide straightforward terms.

Moreover, OppLoans’ commitment to customer support is remarkable. Whether you’re a first-time borrower or experienced with personal loans, OppLoans is there to assist you!

In your journey toward financial stability, expect OppLoans to be more than just a lender. In other words, they’re a supportive companion on your financial path.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Are you ready to review both the advantages and disadvantages of OppLoans? This online lender has carved a distinctive niche in the lending industry, catering to a diverse range of borrowers.

So, join us as we navigate the terrain of OppLoans’ offerings, dissecting the benefits that make them a compelling choice for many while also addressing the potential drawbacks that you should consider.

Pros

- Suitable option for those with less-than-perfect credit;

- Fast approval decisions;

- Transparent loan terms;

- Flexible repayment options;

- OppLoans does not impose prepayment penalties;

- Versatility in use.

Cons

- May have interest rates that are higher than those offered by traditional banks;

- Not be available in all states;

- Short to medium-term financial needs.

What are the eligibility requirements?

Eligibility for OppLoans’ wide range of lending products requires individuals to meet specific criteria. They must be 18 years of age or older and possess an active bank account, either checking or savings.

Besides, they must reside in one of the states where OppLoans operates, maintain a dependable source of income, and receive income via direct deposit, ensuring a hassle-free lending experience.

Learn how to request OppLoans

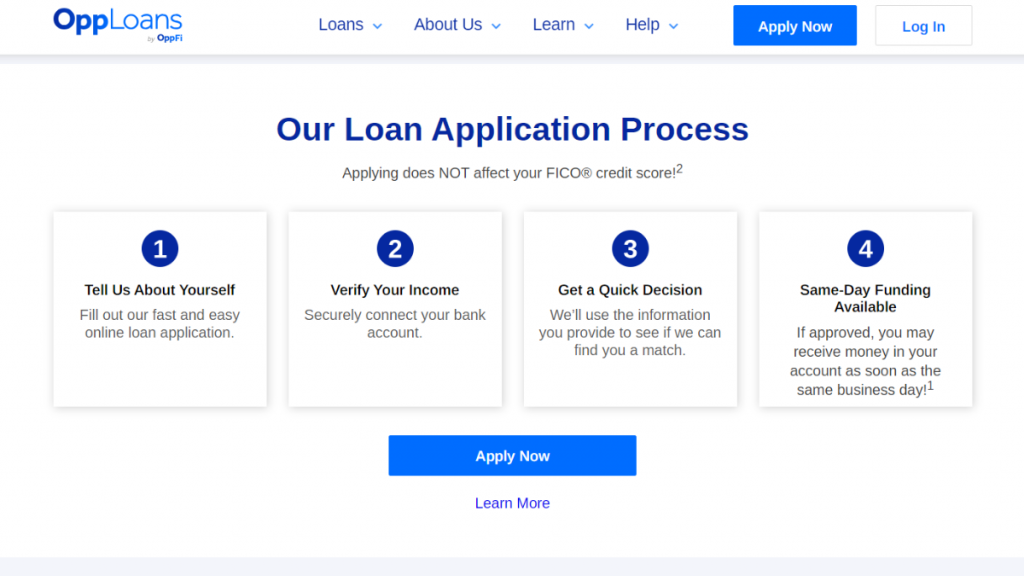

Whether you’re exploring OppLoans for the first time or have already perused our OppLoans review, this step-by-step guide will ensure you have the knowledge you need to initiate your loan application successfully.

Learn how to request online

At OppLoans, the emphasis is on simplicity and inclusivity. So, explore how you can access the funds you need!

- Access the OppLoans website: Begin by visiting the official OppLoans website. Then, click on “Apply Now” to access the form.

- Personal information: Fill in your personal details, including your full name, current contact information, and Social Security Number.

- Bank account details: As OppLoans often requires an active bank account for loan disbursement and repayments, you’ll need to input your bank account information.

- Loan amount and purpose: Specify the amount you wish to borrow and the purpose of the loan.

- Submit: Once you’re done, review your application for a personal loan with OppLoans and submit.

- Funds disbursement: Finally, once you’ve accepted the loan terms, OppLoans will typically disburse the loan funds directly into your bank account, often within the next business day.

What about another recommendation: MoneyLion Loans!

As you can see in our OppLoans review, one standout feature worth mentioning is accessibility. However, if you’re exploring alternative lending options, MoneyLion loans offer a compelling choice.

MoneyLion not only provides personal loans but also offers a comprehensive suite of financial services, including banking, investment, and credit-building tools. So, want to know more details about MoneyLion?

To explore this alternative more deeply, we invite you to read a comprehensive review on MoneyLion, where you can see the wide array of services they provide and make an informed decision!

MoneyLion Loans review

Discover the pros and cons of MoneyLion Loans in our review. Explore interest rates and application process – affordable loan options!

Trending Topics

Walmart MoneyCard Review: Manage Your Money Hassle-free!

Discover the convenience of the Walmart MoneyCard in this review. Enjoy cashback rewards, overdraft protection, and early direct deposit.

Keep Reading

Discover the Best Apps When Traveling for a Seamless Journey

Explore the best apps when traveling for stress-free journeys. From cheap flights and hotels to offline maps, travel smarter!

Keep Reading

Security Token Crypto: everything you need to know about it

Security token is a new digital asset, similar to traditional securities. Find out how these assets work and what you need to know about it.

Keep ReadingYou may also like

Cost-of-living adjustments will have a significant increase for 2023

The new cost-of-living adjustments for 2023 will be announced next Thursday, and retirees can expect a significant increase.

Keep Reading

Apple is raising prices on all its subscription services

Apple is currently raising prices on a number of subscription services to cover licensing costs. Read on to learn what this means for you!

Keep Reading

Top investments for starters: 8 ways to start building your wealth!

Are you ready to get started investing? We've got 8 top investments for starters. Pick whichever one strikes your fancy, and start there!

Keep Reading