Debit Cards (US)

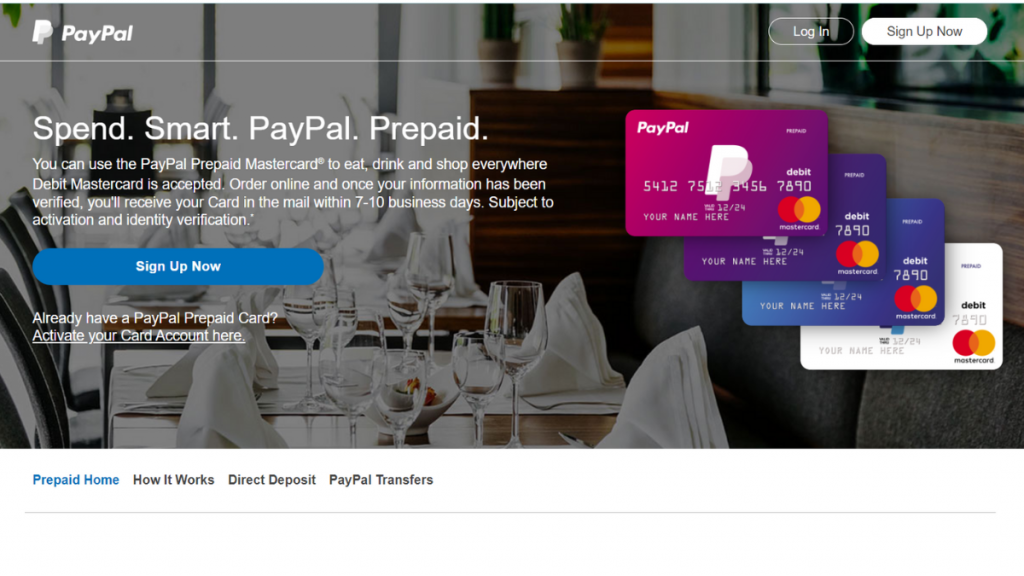

PayPal Prepaid Mastercard® Review: Embrace Digital Finance!

The PayPal Prepaid Mastercard® is your path to smarter money management. Learn how to make the most of this card's features for convenient spending and saving.

Advertisement

Explore the benefits of direct deposit, special offers, and mobile app convenience!

In a world where digital financial solutions are shaping the way we manage our money, review the PayPal Prepaid Mastercard® to find a powerful player in the field of convenient financial tools.

If you’re eager to streamline your day-to-day transactions, gain early access to your funds, and explore exciting rewards, this card may hold the key to reshaping your financial journey.

- Credit Score: N/A;

- Annual Fee: The PayPal Prepaid Mastercard® comes with an annual fee of $4.95 per month.

- Intro offer: While the PayPal Prepaid Mastercard® doesn’t typically offer traditional introductory bonuses like some credit cards, it does provide other enticing features.

- Rewards: Cardholders unlock special store offers and Payback Rewards. Plus, our Refer-A-Friend program lets you and a buddy pocket $20 in credits when they order a new card, verify their identity, and load at least $40 onto their Card Account. It’s a rewarding experience that comes with the PayPal Prepaid Mastercard®.

- Other Fees: N/A.

PayPal Prepaid Mastercard®: What can you expect?

The PayPal Prepaid Mastercard® is a gateway to reshaping how you manage your finances in a rapidly evolving digital landscape, so stay tuned in this review to find out everything it has to offer!

At its essence, the PayPal Prepaid Mastercard® establishes a direct link with your established PayPal account. Moreover, you can use it to access your PayPal balance or load funds through Direct Deposit.

So, it’s your key to versatile spending, as you can use it wherever a Debit Mastercard is accepted, whether for everyday purchases, dining, or online shopping.

Furthermore, this card boasts a rewarding program that grants you access to exclusive deals and Payback Rewards every time you shop at select stores. Plus, there’s a Refer-A-Friend program!

In this manner, both you and a friend can claim a $20 credit. All it takes is your friend ordering a new card, verifying their identity, and loading a minimum of $40 onto their Card Account. It’s a win-win situation.

Besides, the PayPal Prepaid mobile app complements the card, offering on-the-go account management. While it offers numerous benefits, it’s essential to consider its cost, which includes a $4.95 per month plan fee.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

Indeed, in this PayPal Prepaid Mastercard® review, we’ll delve into the card’s notable advantages and potential drawbacks, offering you a comprehensive perspective to help you make an informed decision.

Pros

- Freedom to spend your funds wherever a Debit Mastercard is accepted;

- Swift card delivery;

- Early fund access;

- Indulge in distinctive offers and reap the benefits of Payback Rewards;

- Refer-a-friend incentives;

- Mobile financial management.

Cons

- Monthly fee;

- Limited Direct Deposit control;

- No traditional introductory offers.

What are the eligibility requirements?

So, eligibility for the PayPal Prepaid Mastercard® typically requires applicants to be at least 18 years old, U.S. residents (with possible variations for non-U.S. residents), and to provide personal information.

Learn how to get the PayPal Prepaid Mastercard®

So, applying for the PayPal Prepaid Mastercard® is a straightforward process that you can review below. Get on the path to financial convenience now!

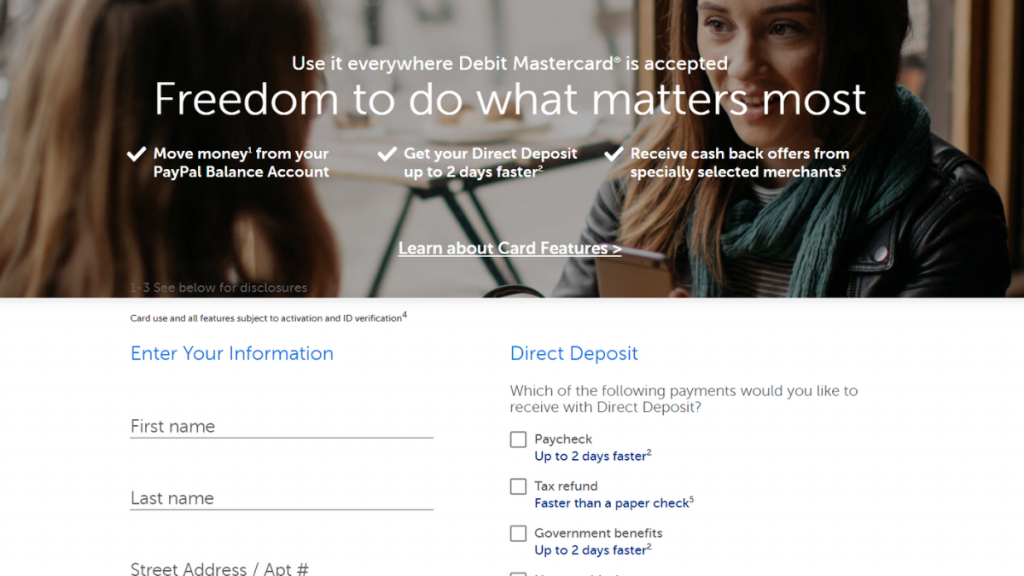

Apply online

By following simple steps, you can apply for and start enjoying the benefits of the PayPal Prepaid Mastercard®, which offers a convenient way to manage your finances in the digital age.

- Visit the official website: Firstly, begin your journey by visiting the official PayPal website. There, click on the option “Personal” on the main menu and then “PayPal Credit and Cards.” Simply continue scrolling until you spot the PayPal Prepaid Mastercard®.

- Provide your information: To start the application process, you’ll be asked to furnish vital personal details, including your name, address, date of birth, and social security number. This information plays a crucial role in verifying your identity.

- Verification process: Once you’ve entered your details, the verification process begins. This may involve confirming your identity.

- Order your personalized card: Finally, after successful verification, you can proceed to order your personalized PayPal Prepaid Mastercard®. This card will be sent to your mailing address, typically arriving within 7-10 business days.

What about a similar credit card? Check out the Mission Money™ debit card!

If you’re on the hunt for an alternative to the PayPal Prepaid Mastercard®, the Mission Money™ Debit Card is a compelling choice to review. This is a gateway to simplified, empowered finances.

So, explore features like direct deposit, rewards, and savings options that redefine how you handle your finances. It’s time to take charge of your financial future! Further, see the full review below!

How to apply for the Mission Money™ debit card

Want an easy way to get your hands on some cash? Apply for the Mission Money™ debit card and have your funds available anytime, anywhere.

Trending Topics

Vast Visa® Platinum Card: Financial Freedom!

Read this review and find out why the Vast Visa® Platinum Card is your key to financial empowerment. No annual fees and intro APR included!

Keep Reading

SavorOne Rewards Credit Card review

Looking for a card with amazing rewards? Check out our SavorOne Rewards Credit Card review to see if it's the right one for you.

Keep Reading

See how to apply for the Chase Freedom Unlimited® Card

Learn how to apply online for the Chase Freedom Unlimited® Card and start earning rewards on things that really matter, every day.

Keep ReadingYou may also like

Change these Windows 11 settings to optimize your PC

Learn how to change a few Windows 11 default settings to optimize your computer’s potential, improve your security, and much more!

Keep Reading

The best horror movies on Amazon Prime

Looking for a good horror movie to watch? Here’s a list of the best horror movies on Amazon Prime that will creep you out - like you want to.

Keep ReadingThe News Stacker recommendation – United Quest℠ Card

Get rewarded for your travel experiences with the United Quest℠ Card! Find out how you can maximize your mileage today!

Keep Reading