Why not make your financial journey liberating with personalized interest rates?

ANZ Personal Loans offers you freedom to borrow up to $50,000 without securing it against assets!

Advertisement

The ANZ Personal Loans makes dreams get a green light! Need a new car, a dream wedding, or just a well-deserved holiday? Enjoy the magic of personalized rates, up to $500 cashback, and the freedom to choose between stability with a Fixed Rate Loan or flexibility with a Variable Rate Loan. Your story, your way!

The ANZ Personal Loans makes dreams get a green light! Need a new car, a dream wedding, or just a well-deserved holiday? Enjoy the magic of personalized rates, up to $500 cashback, and the freedom to choose between stability with a Fixed Rate Loan or flexibility with a Variable Rate Loan. Your story, your way!

You will remain in the same website

Whether it's upgrading appliances, planning a vacation, or making a significant purchase, the ANZ Personal Loans can make it happen! Discover some of the benefits you get when requesting this loan!

You will remain in the same website

Whether you’re eyeing a new car, envisioning the perfect holiday, or planning a fairy-tale wedding, ANZ Personal Loans extend a helping hand with a touch of personalization. Explore some features now!

Upsides and benefits of ANZ Personal Loans

- Personalized Interest Rates: Your credit score isn’t just a number; it’s the key to unlocking a personalized interest rate with ANZ. The better your credit, the better your rate, making your borrowing experience uniquely tailored to your financial standing.

- Same-Day Cash Access: Need funds urgently? ANZ Personal Loans offer the convenience of same-day cash for in-branch applications approved by midday, Monday to Friday. Seize opportunities and tackle unforeseen expenses without delay.

- Up to $50,000 Without Collateral: Bid farewell to the hassle of providing assets as security. ANZ lets you borrow up to $50,000 without tying it to your home or any other asset, providing the freedom to pursue your financial goals without unnecessary constraints.

- $500 Cashback Incentive: Planning a significant purchase or embarking on a sizeable project? ANZ sweetens the deal with a generous $500 cashback offer on loans of $10,000 or more, giving you a financial boost to kickstart your plans.

- Flexible Loan Options: Choose a loan that aligns with your financial strategy. ANZ offers both Fixed Rate Loans, providing stability with consistent repayments, and Variable Rate Loans, offering flexibility with the ability to make early repayments without additional costs.

Drawbacks of ANZ Personal Loans

- Loan Approval Fee: ANZ charges a $150 loan approval fee, a consideration to factor into your overall borrowing costs.

- Loan Administration Charge: A $10 monthly loan administration charge, debited every three months until the loan is closed in ANZ systems, may accumulate over the loan term.

- Late Payment Fee: Late repayments, five days or more overdue, incur a $20 fee, with an additional $20 monthly charge until repayments are brought up to date.

- Early Repayment Charges for Fixed Rate Loans: If you opt for a Fixed Rate Loan, early or additional payments may incur Early Repayment Costs, which could be substantial. Be mindful of this if you plan to pay off your loan ahead of schedule.

ANZ understands the importance of timely financial support. For in-branch applications approved by midday, Monday to Friday, same-day cash access is facilitated. This means that if you’re in need of funds urgently, ANZ provides a solution, allowing you to seize opportunities or address unforeseen expenses without unnecessary delays.

ANZ offers the freedom to borrow up to $50,000 without the need for collateral. This feature is particularly advantageous for individuals who may not want to secure their loan against assets like their home. It allows borrowers to pursue their financial goals without the added complexity of tying up valuable assets.

ANZ recognizes that one size does not fit all in the realm of personal loans. Therefore, they offer two main types: Fixed Rate Loans and Variable Rate Loans. Fixed Rate Loans provide stability with consistent repayments, shielding you from potential interest rate increases. On the other hand, Variable Rate Loans offer flexibility, allowing you to make early repayments without additional costs and providing access to extra money paid through redraw facilities.

The ANZ Personal Loans can be a flexible opportunity when it comes to realizing your dreams. From personalized rates to quick cash access and enticing cashback offers!

Navigate your financial ambitions with confidence, knowing that ANZ is not just a lender but a companion on your journey! Want to know more about this financial tool? Then access a full review now!

ANZ Personal Loans Review: Get the Funds You Need!

Discover the flexibility of ANZ Personal Loans in this review! From tailored interest rates to same-day cash for in-branch applications.

However, if you feel like you need money faster than the ANZ can give you, Quick Cash Loans can be a compelling alternative! Whether faced with unexpected bills or seizing an unforeseen opportunity.

Quick Cash requires minimal documentation! Intrigued? As with any financial decision, it’s essential to weigh the benefits and drawbacks. So dive into a complete review of Quick Cash Loans!

See how to apply for Quick Cash Loans

Are you looking for an instant financial solution tailored to your budget? Apply for Quick Cash Loans today and borrow the money you need.

Trending Topics

Westpac Lite Credit Card review: Simplify Your Finances!

Discover the features of the Westpac Lite Credit Card in our in-depth review. Make an informed decision about your next credit card choice!

Keep Reading

Progen Lending Solutions review: Get the perfect financial solution for you

Our comprehensive Progen Lending Solutions review will help you discover how to get the perfect financial solution for your needs.

Keep ReadingThe News Stacker recommendation – Bankwest Breeze Classic Mastercard Credit Card review

Learn how the Bankwest Breeze Classic Mastercard Credit Card can increase your purchasing power and help you save money!

Keep ReadingYou may also like

Cash Stop Loans review: An Online Alternative to Payday Loans

Read this review of Cash Stop Loans and find out how they can provide you with a reasonable alternative to payday lenders - up to $5K easily!

Keep Reading

Bendigo Ready Credit Card Review: Ignite your travel dreams

Get ready for spontaneous trips abroad! Check out our detailed Bendigo Ready Credit Card review to learn about it. Start your journey here!

Keep Reading

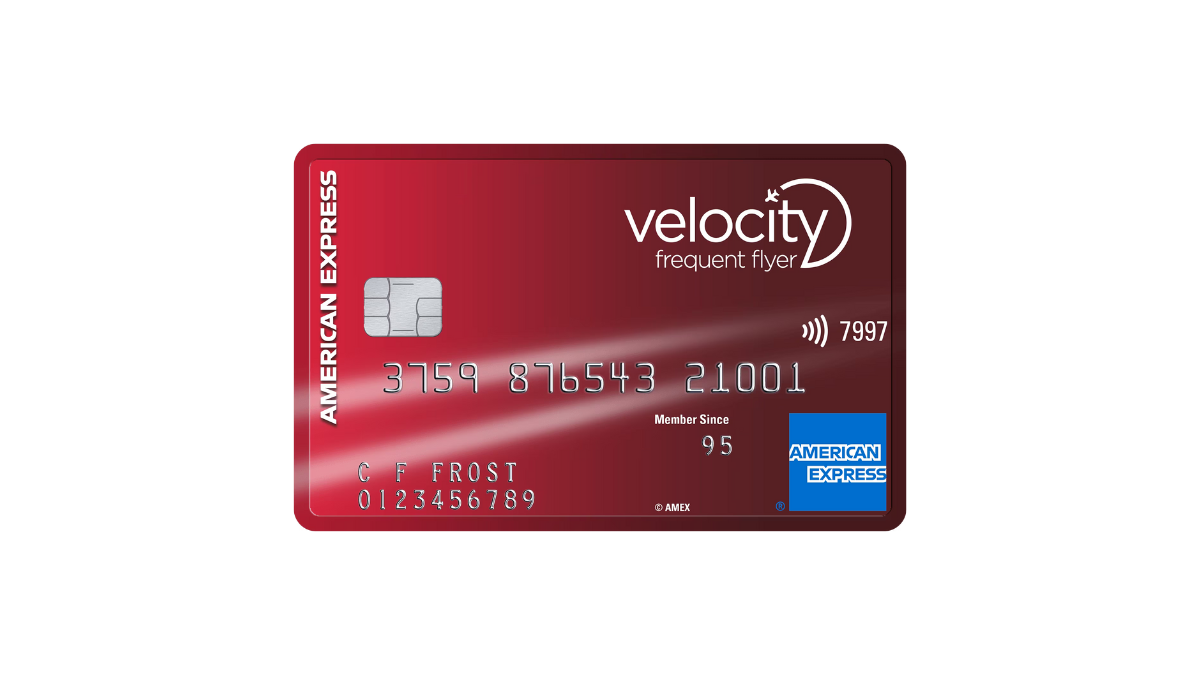

American Express Velocity Escape Review: up to 1.75 points on purchases!

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Keep Reading