Travel the world with ease and enjoy complimentary insurance benefits.

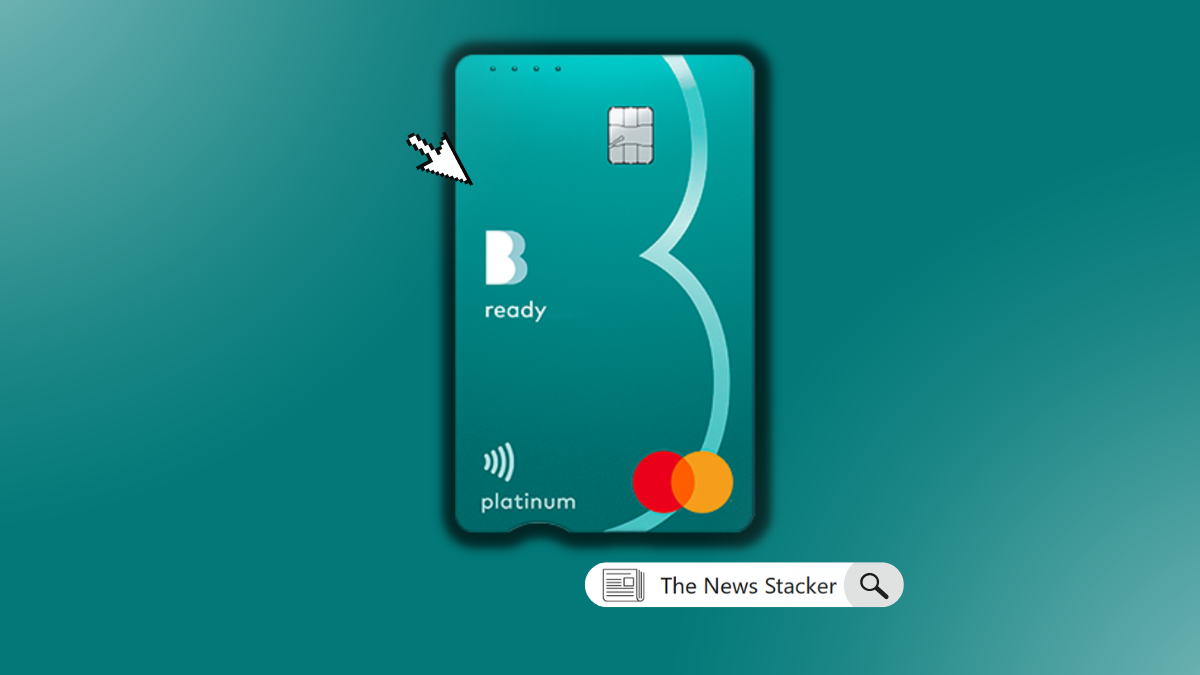

Bendigo Ready Credit Card – Get up to 55 days interest free on purchases

Advertisement

If you’re looking for a flexible and convenient way to manage your finances, then the Bendigo Ready Credit Card might be just what you need! This no-fuss, the easy-to-use card offers great benefits for all types of consumers. There’s no limit on how far the Bendigo Ready Credit Card can take you!

If you’re looking for a flexible and convenient way to manage your finances, then the Bendigo Ready Credit Card might be just what you need! This no-fuss, the easy-to-use card offers great benefits for all types of consumers. There’s no limit on how far the Bendigo Ready Credit Card can take you!

You will remain in the same website

This credit card offers some of the best competitive rates currently available in Australia, offering unbeatable returns for cardholders. So if you want to take advantage of all these perks, read on to learn more about what makes this credit card so appealing!

You will remain in the same website

The Bendigo Ready credit card is the perfect companion for all your travels – no matter where life takes you, it’s got your back! Enjoy a world of convenience with Mastercard— accepted in millions of locations around the globe.

Need to shop around the world? The international fee covers all your purchases made in a foreign currency. So don’t worry – you can go shopping stress-free!

Not sure how much credit you need? Bendigo Ready’s minimum limit is $3000, but if you’re looking for more spending power, why not apply and see what kind of higher limits can be offered?

Ready for the world? Make it happen with the Bendigo Bank Ready Credit Card! This card lets you flex those traveling muscles to explore the globe hassle-free.

With plenty of perks, this card is enough to help you wander comfortably.

So don’t just wait for your dreams to come true. Apply for the Bendigo Bank Ready Credit Card and take your wallet on an adventure with you.

See how to apply for the Bendigo Ready Credit Card

Don't wait around – learn how to apply for the Bendigo Bank Ready Credit Card and explore all its stellar value and platinum travel perks.

Looking for a trusty, stress-free way to pay? CommBank Neo Credit Card has you covered!

With three credit limits to choose from and an easy-to-understand monthly fee that won’t change without warning, plus no interest and no late fees.

Along with its very own reward system – eligible cardholders have cashback benefits. Now, who wouldn’t want to apply for it?! Check out the application guide below.

How to apply for the CommBank Neo Card

Learn how to apply for the CommBank Neo card, including eligibility requirements and documents required. Read on for more!

Trending Topics

Quick Cash Loans review: Quick & Easy Access to the Funds You Need Online

Unexpected expenses can pop up out of nowhere. Get informed and decide if Quick Cash Loans are the right online lending option - up to $5K!

Keep ReadingThe News Stacker recommendation – NAB StraightUp Credit Card review

Find out why the NAB StraightUp Card is one of Australia's most popular credit cards for savvy customers and how to apply for it!

Keep Reading

ANZ Rewards Platinum Credit Card: Your Ticket to Exclusive Perks!

Explore the ANZ Rewards Platinum Credit Card! With a generous rewards program, exclusive travel perks, and more!

Keep ReadingYou may also like

ANZ First Credit Card: Effortless Financial Control!

Unlock the benefits of the ANZ First Credit Card to make an informed choice! Learn about its robust security, flexible payments, and more!

Keep Reading

Household Capital Loans review: Get the financing you need – no matter your age

Ready to upgrade your home loan? Get all the information you need right here with our comprehensive Household Capital Loans review.

Keep Reading

How to apply for The Qantas American Express Ultimate Card

Ready to take the plunge and apply for your Qantas American Express Ultimate Card? Get lounge passes, travel insurance, and more.

Keep Reading