Get the loan you need when you need it with no hidden fees and interest rates

Capfin Loan – Get a loan from R500 to R50 000

Advertisement

Do you need financial help to make ends meet or cover an unexpected expense? A Capfin loan might be just the solution for you. With a hassle-free application process and competitive interest rates, it’s no wonder why Capfin loans are quickly becoming one of the most popular ways for people to get access to cash quickly.

Do you need financial help to make ends meet or cover an unexpected expense? A Capfin loan might be just the solution for you. With a hassle-free application process and competitive interest rates, it’s no wonder why Capfin loans are quickly becoming one of the most popular ways for people to get access to cash quickly.

You will remain in the same website

Capfin offers quick loan solutions that make it easy for anyone in South Africa who needs access to credit. Read on as we explain how Capfin works.

You will remain in the same website

To apply for a Capfin Loan, you must be an adult over 18 with permanent employment and a regular salary. Bring your valid SA ID, 3 most recent payslips or bank statements, and proof of your cellphone number.

Capfin loans offer an easy, convenient way to access financial assistance when you need it. Whether online, via SMS or in-person at select PEP and Ackermans stores – applying for a Capfin loan is simple!

To determine the loan amount you may qualify for, apply for a Capfin loan. Upon completing our affordability assessment, you will receive an offer with details on the maximum amount available to borrow!

Wondering how much you can borrow? You could qualify for a loan of up to R50 000! What’s more, your personal affordability assessment takes into account factors such as income and expenses, credit profile and payment behavior – making it tailored to meet your financial needs.

Need a loan fast? Capfin could be the answer! This convenient and flexible solution is perfect for South Africans needing quick credit.

With easy access to cash, you’ll have your financial issues sorted out before you know it! Click on the link below and apply today!

How to apply for the Capfin Loan?

Looking for a reliable and transparent loan service? Apply for Capfin Loan! This guide will show you how to get started.

Get ahead faster with DirectAxis Loan! Boasting a hassle-free online application process and fast decision times of minutes. All backed up by friendly financial advisors – you can get access to loans from R1,000 all the way through to R200, 000.

Qualifying is easy, too: simply ensure your credit record is in good order. Have an average income over the last 3 months greater than or equal to R5000 per month, and provide them with details of the bank account into which your salary’s paid.

If you’re ready to take advantage of this amazing offer, follow the link below and learn how to apply!

See how to apply for a DirectAxis Loan

Learn how to apply for a DirectAxis Loan and get the cash you need to cover your expenses. Their online process makes it easy!

Trending Topics

Standard Bank Platinum Credit Card review

With the Standard Bank Platinum Credit Card, you get access to a world of exclusive benefits. Read our full review to get the full scoop!

Keep Reading

Woolworths Gold credit card review: Get rewards and cashback offerings!

If you're looking for a credit card with great rewards and cashback offers, read our Woolworths Gold Credit Card review and learn more.

Keep ReadingYou may also like

See how to apply for the FNB Personal Loans

Learn how to apply for the apply FNB Personal Loans. Our step-by-step guide will make the process easy and straightforward. Read on for more!

Keep Reading

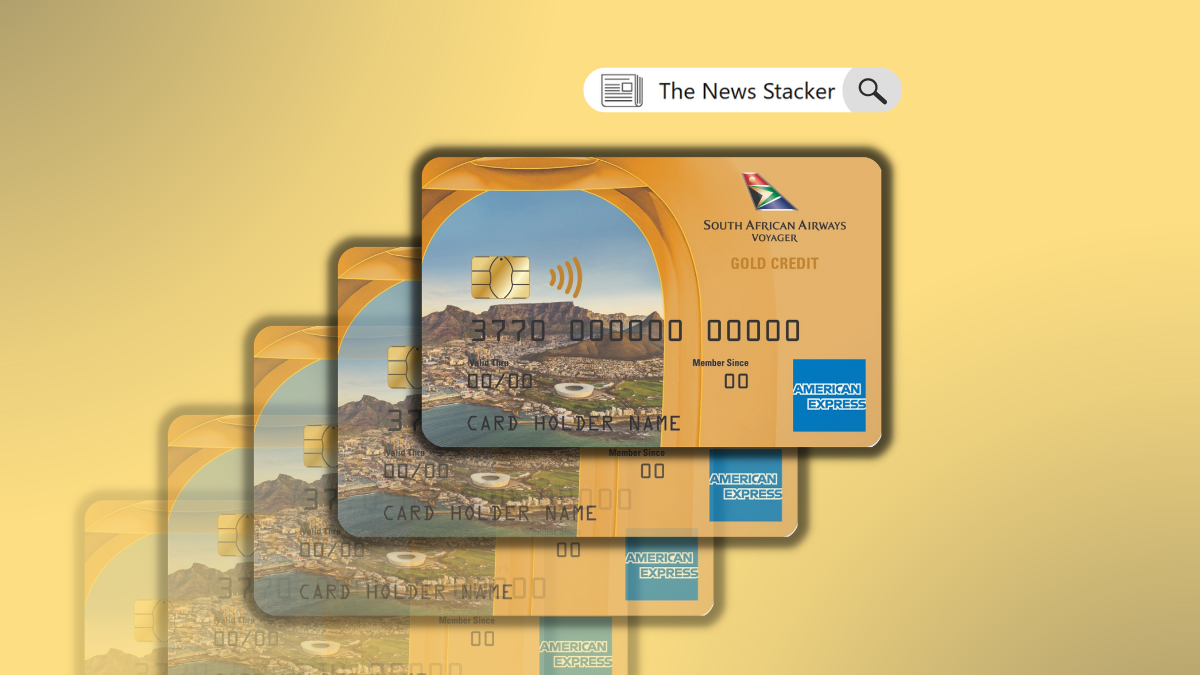

NedBank SAA Voyager Gold Credit Card review: Unlock the golden ticket of travel

Are you a frequent traveler looking for an amazing rewards card? Check out our NedBank SAA Voyager Gold Credit Card review.

Keep Reading

FNB Aspire Credit Card review

Are you looking for a credit card that offers you value and rewards? Then check out our in-depth FNB Aspire Credit Card review.

Keep Reading