Have access to 14 months of 0% p.a. on purchases and balance transfers with ZERO balance transfer fees!

Citi Rewards Card – No annual fee during your first year as a member and rewards points on every purchase!

Advertisement

Are you looking to get rewarded for your purchases? With the Citi Rewards Card, you’ll benefit from excellent rewards – earning points every time you shop and redeeming them when it suits you. You’ll get a lengthy 0% p.a. for 14 months, $0 annual fee in your first year, and much more! Check our full review to learn everything that this innovative card can do for you.

Are you looking to get rewarded for your purchases? With the Citi Rewards Card, you’ll benefit from excellent rewards – earning points every time you shop and redeeming them when it suits you. You’ll get a lengthy 0% p.a. for 14 months, $0 annual fee in your first year, and much more! Check our full review to learn everything that this innovative card can do for you.

You will remain in the same website

If you’re looking for a rewards card that maximizes your spending potential and provides amazing deals, the Citi Rewards Card is perfect for you. Check some of its incredible perks below!

You will remain in the same website

The Citi Rewards Card is a credit card that offers rewards points for purchases. It may be best for individuals who frequently use their credit card for everyday purchases and want to earn rewards points that can be redeemed for a variety of rewards such as flights, merchandise, or cashback. The card also offers a range of complimentary benefits, including an extensive 0% p.a. period, travel insurance, purchase protection, and access to exclusive events.

Yes. The Citi Rewards Card offers all members complimentary mobile insurance. There’s monthly coverage on eligible phones against damage or theft as long as you pay your monthly bill using your credit card.

Yes, the Citi Rewards Card does offer travel insurance as a complimentary benefit. The card provides international travel insurance for trips up to six months in duration, including coverage for medical expenses, trip cancellation or interruption, and lost or stolen luggage or travel documents. To activate the travel insurance, the cardholder must meet certain eligibility criteria, such as paying for a portion of their trip with their Citi Rewards Card or using their rewards points to book eligible travel.

If you’re ready to step up your credit card game with the Citi Rewards Card, check the following link and learn how you can easily apply for it.

How to apply for the Citi Rewards Card

Follow this easy guide and learn how to apply for the Citi Rewards Card. Save money, earn rewards, and have control over your finances!

But if you’d like to learn about a different card with great perks and no fees, we recommend the NAB StraightUp Credit Card. Check the link below to learn about its features and benefits and how to apply for it.

How to apply for the NAB StraightUp Credit Card

Looking for a credit card that suits your needs? Here's how you can apply for the NAB StraightUp Credit Card and get the best perks!

Trending Topics

The News Stacker recommendation – Bankwest Breeze Classic Mastercard Credit Card review

Learn how the Bankwest Breeze Classic Mastercard Credit Card can increase your purchasing power and help you save money!

Keep Reading

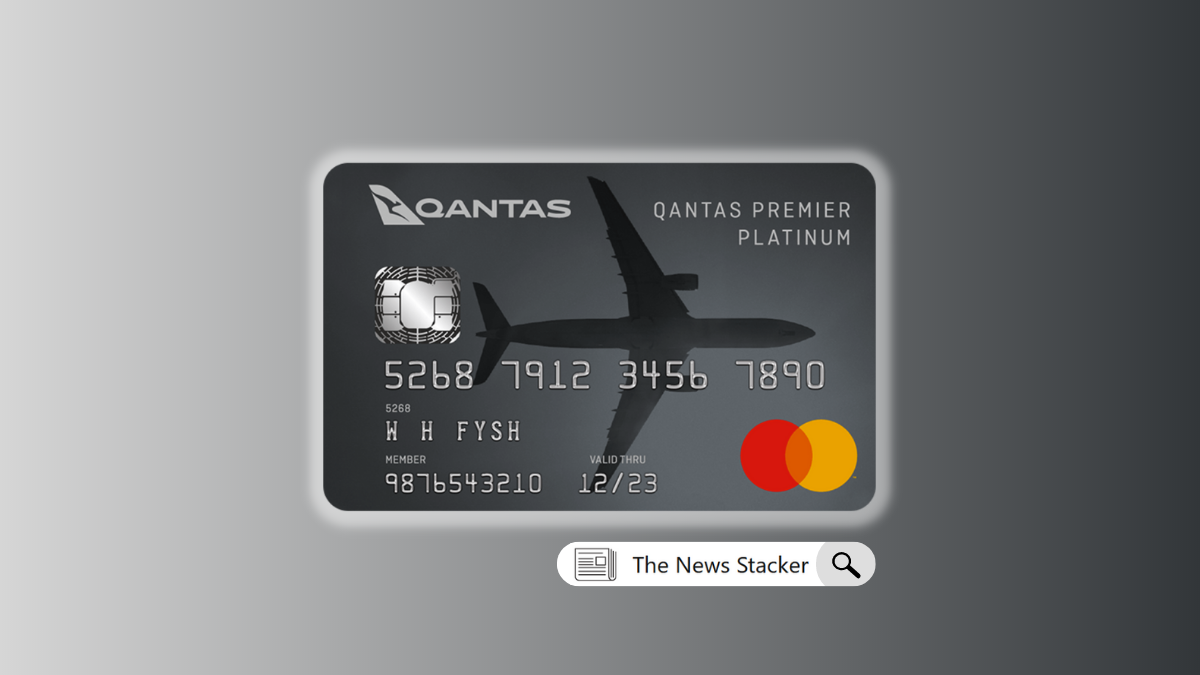

See how to apply for the Qantas Premier Platinum Credit Card

Find out how to apply for the Qantas Premier Platinum Credit Card today and take advantage of exclusive rewards.

Keep Reading

See how to apply for the Household Capital Loans

Looking to purchase your dream home? Here's how to apply for a Household Capital Loans and get the best interest rate possible.

Keep ReadingYou may also like

How to apply for the Low Rate Credit Card from American Express®

Find out all the features and benefits when you apply for The Low Rate Credit Card from American Express® today! Read on!

Keep Reading

ING Orange One Low Rate Review: Smart Spending Unleashed!

Discover financial freedom in this ING Orange One Low Rate review. Enjoy zero ING fees on international transactions for eligible users.

Keep Reading

Harmoney Personal Loan Review: Empowering Your Aspirations!

From car loans to dream weddings, learn to get tailored solutions in this Harmoney Personal Loan review! Your unique journey begins here!

Keep Reading