Read more to see how this card can build your credit score

Citi® Secured Mastercard® Credit Card – Affordable rates and strong oversight by Citibank

Advertisement

Are you looking for a great way to build or rebuild your credit history? Then the Citi® Secured Mastercard® Credit Card might be the right card for you. With affordable rates, enticing benefits, and strong oversight by Citibank, this secured credit card could be an excellent tool in helping you establish or re-establishing your credit profile.

Are you looking for a great way to build or rebuild your credit history? Then the Citi® Secured Mastercard® Credit Card might be the right card for you. With affordable rates, enticing benefits, and strong oversight by Citibank, this secured credit card could be an excellent tool in helping you establish or re-establishing your credit profile.

You will remain in the same website

Read on to learn more about what this card offers, including features and benefits such as fraud protection, flexible payment options, access to your Experian credit score, and no annual fee.

You will remain in the same website

Get access to the financial benefits of a credit card with the Citi® Secured Mastercard®, which can be found in banks and stores throughout America.

If you have limited or no credit history, the Citi® Secured Mastercard® is the perfect card for you! No minimum score necessary to be approved – start building your financial future today.

You’ll need to share your name and date of birth, Social Security number, residential address, email address, and phone number, along with details about annual income and monthly rent/mortgage payments.

Citi allows you to build up your credit and score a better card at the same time! With responsible spending, you can upgrade from secured to unsecured credit cards – giving yourself more financial flexibility.

Are you looking for an opportunity to build your credit and learn more about responsible money management? Consider applying for the Citi® Secured Mastercard® Credit Card.

This card helps consumers take control of their finances. With convenient access to rewards, detailed reporting, and helpful tools to manage their spending and establish a credit history. Follow the link below to learn how to apply for this great card today!

See how to apply for the Citi® Secured Mastercard®

Learn how to apply for the Citi® Secured Mastercard®, a secured credit card that can help you rebuild your credit history.

And even though the Citi® Secured Mastercard® Credit Card is a great option. The Discover It® Secured Credit Card offers a great chance to reap the rewards of financial services with no annual fee.

You can deposit anywhere from $200 – $2,500 and get access to your maximum credit limit!

Plus, you’ll enjoy cash back matched by Discover’s Intro Offer after one year . And special rewards like cash back on gas station & restaurant purchases and everything else.

Plus, 0 foreign transaction fees make this card even more attractive. Start building that credit today and learn how to apply in the link below!

How to apply for the Discover It® Secured card?

Learn how to apply for the Discover It® Secured Credit Card. And let this secured credit card help you regain control of your finances!

Trending Topics

Learn how to prevent nightmares after watching scary movies

Getting your fix of scary movies during Halloween? Here’s how you can prevent nightmares after watching your favorite horror movies.

Keep Reading

MoneyLion Loans review: Is It the Right Financial Product for You?

Discover the pros and cons of MoneyLion Loans in our review. Explore interest rates and application process - affordable loan options!

Keep Reading

Netflix’s ad-supported tier is coming in November

Netflix is finally rolling out its ad-supported tier plan in November! Read on to learn more about the service and how to subscribe to it.

Keep ReadingYou may also like

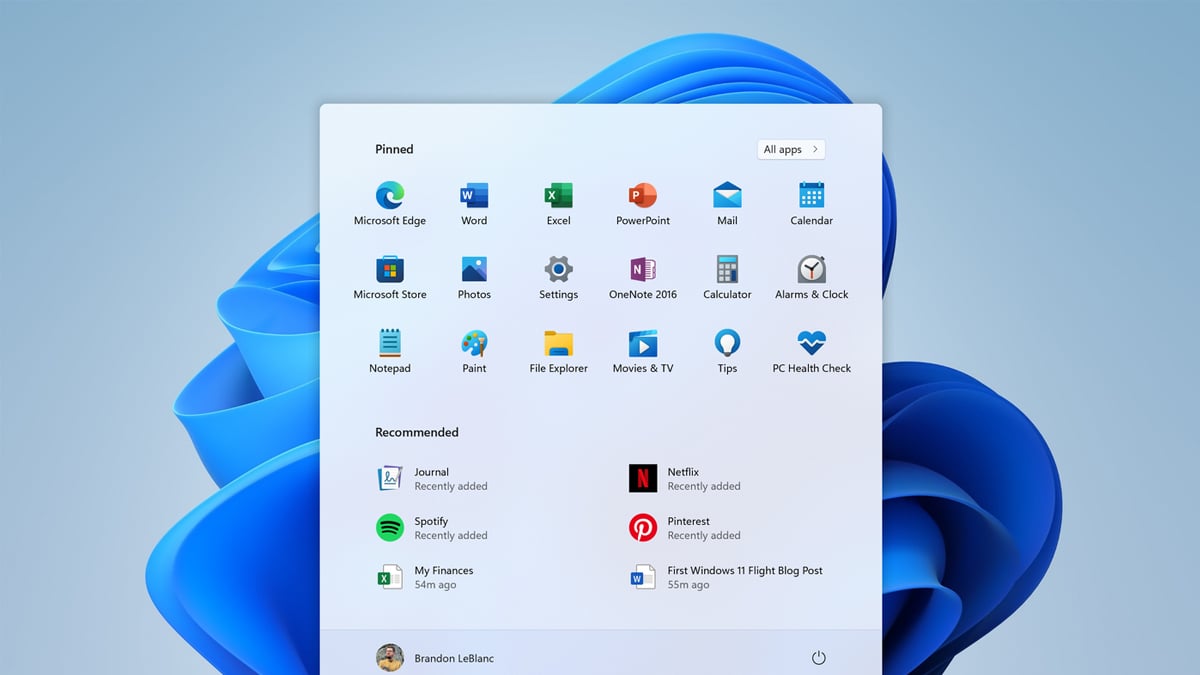

Change these Windows 11 settings to optimize your PC

Learn how to change a few Windows 11 default settings to optimize your computer’s potential, improve your security, and much more!

Keep Reading

How to choose the best bank for you? Learn the key points

Learn how to choose the best bank and enjoy a good financial management. It is important, so read this post all the way.

Keep Reading

Many wealthy American people are renouncing their U.S. citizenship

If wealthy people are renouncing their American citizenship, where are they going? How does this impact economy? Read to find out.

Keep Reading