Credit Cards (US)

Upgrade Visa® Card with Cash Rewards review: Enjoy Low Interest Rates & No Annual Fees

Get maximum value from your everyday spending! Check out our review of the Upgrade Visa® Card with Cash Rewards. Benefits like competitive cash rewards and reliable customer service make this one of the best cards on the market.

Advertisement

Upgrade Visa® Card with Cash Rewards: Get 1.5% Cash Back Instantly

Are you looking for a cash-back credit card to kickstart your reward program? Check out our Upgrade Visa® Card with Cash Rewards review!

See how to apply for the Upgrade Visa® Card!

Find out how to apply and access the Upgrade Visa® Card with Cash Rewards! Enjoy competitive interest rates, 1.5% cash back.

With competitive cash rewards and reliable customer service, this is one of the best cards on the market.

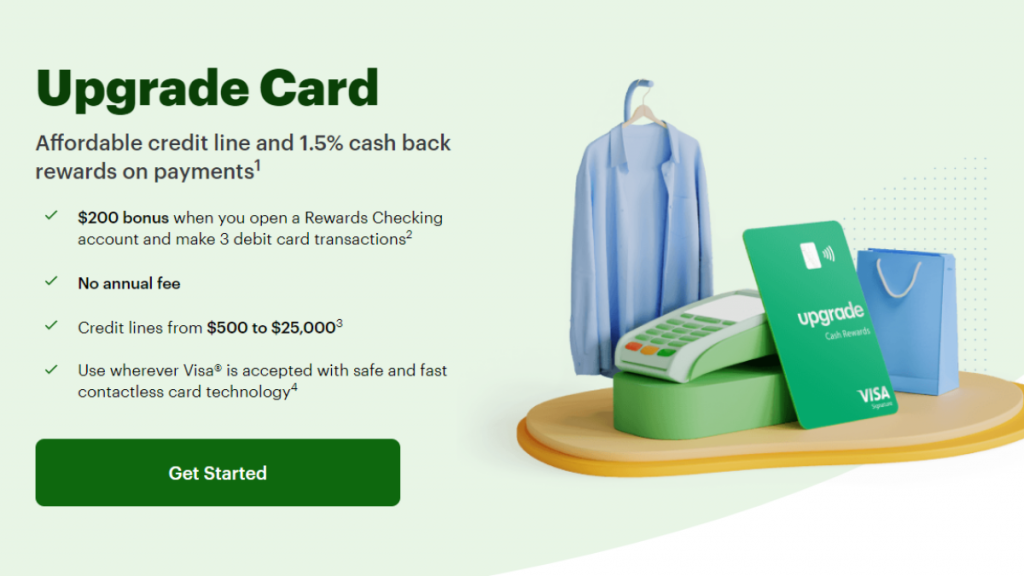

- Credit Score: Fair to Good (580 – 740)

- Annual Fee: $0

- Intro offer: $200 bonus after opening a Rewards Checking account and making 3 debit card transactions

- Rewards: 1.5% unlimited cash back on card purchases every time you make a payment

- APRs: 14.99% – 29.99% APR

- Other Fees: None

Continuação da introdução (1 ou 2 parágrafos curtos, de até 3 linhas no máximo)

Upgrade Visa® Card with Cash Rewards: What can you expect?

When it comes to credit cards, the fees and interest rates can add up quickly.

That’s why finding a card that doesn’t charge annual or foreign transaction fees, cash advance fees, or prepayment penalties is refreshing.

Even better, the Upgrade Visa® Card with Cash Rewards may be available to those with fair credit, so make sure to review your credit score.

The interest rates vary from 14.99% to 29.99% APR, and credit lines range from $500 to $50,000.

While the repayment options are limited to 24-, 36-, or 60-month installment plans, cardholders can earn 1.5% cash back on purchases when they pay their bill.

Additionally, the card comes with Visa Signature benefits and requires automatic payments to qualify for the lowest APR.

With all these features combined, the Upgrade Visa® Card with Cash Rewards is worth considering for those looking to save money and improve their credit.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Ready to make the finishing touches on this Upgrade Visa® Card with Cash Rewards review? Let’s take a look at its benefits versus drawbacks. Here’s what we’ve come up with!

Pros

- No annual fee

- You can earn 1.5 % unlimited cash back on card purchases.

- Those with excellent credit can get a lower-than-average APR and high credit limit.

- There are no prepayment fees, so you can pay your balance off early without penalty.

Cons

- Potentially high APR

- Less flexible payments

What are the eligibility requirements?

If you’re looking for a way to earn rewards on everyday spending and have a credit score between 580-740, the Upgrade Visa® Card with Cash Rewards may be perfect for you!

This card ensures eligible applicants will receive their cash back in no time at all.

Learn how to request the Upgrade Visa® Card with Cash Rewards

If you like what you’ve seen in this Upgrade Visa® Card with Cash Reward review, our easy-to-use application guide can help you apply in minutes.

See how to apply for the Upgrade Visa® Card!

Find out how to apply and access the Upgrade Visa® Card with Cash Rewards! Enjoy competitive interest rates, 1.5% cash back.

Trending Topics

The best fantasy book series to dive into right now

Whether you're a new fan or been reading the genre since childhood, these are the best fantasy book series that you need to read.

Keep Reading

A secured credit card can help you raise your credit score

Getting a secured credit card is a smart way to raise your credit score. This post has some useful tips you have to know to achieve your goal

Keep Reading

MyPoint Credit Union Platinum Visa® Review: Rewards and Security!

Discover the MyPoint Credit Union Platinum Visa® in this in-depth review. Earn points and enjoy peace of mind with travel insurance.

Keep ReadingYou may also like

See how to apply for the Citi Rewards+® Credit Card

The Citi Rewards+® Card is perfect for anyone looking to earn rewards on every purchase. See how to apply and start earning today!

Keep Reading

What is the most dangerous game?

In recent years, several dangerous games have gone viral on social media. Know the most dangerous game you should be aware of.

Keep Reading

See your customized Spotify Upside Down Playlist

Ready for 'Stranger Things 4'? Check out Spotify’s personalized Upside Down Playlist, made just for you! Read on for more.

Keep Reading