Credit Cards (US)

Vast Visa® Platinum Card: Financial Freedom!

Build credit, experience financial flexibility and get a low introductory APR, all that and much more with the Vast Visa® Platinum credit card! You can apply online today!

Advertisement

No annual fee and credit-building benefits await you with the Vast Visa® Platinum Card!

If you’re looking to apply for a credit card designed to give you financial flexibility, this review of the Vast Visa® Platinum Credit Card is for you! With low-interest rates and a wide range of benefits, this card is hard to ignore.

The Vast Visa® Platinum Card is more than just a credit card, it’s a powerful financial tool designed to simplify your life!

- Credit Score: No credit score is necessary for approval;

- Annual Fee: No annual fee;

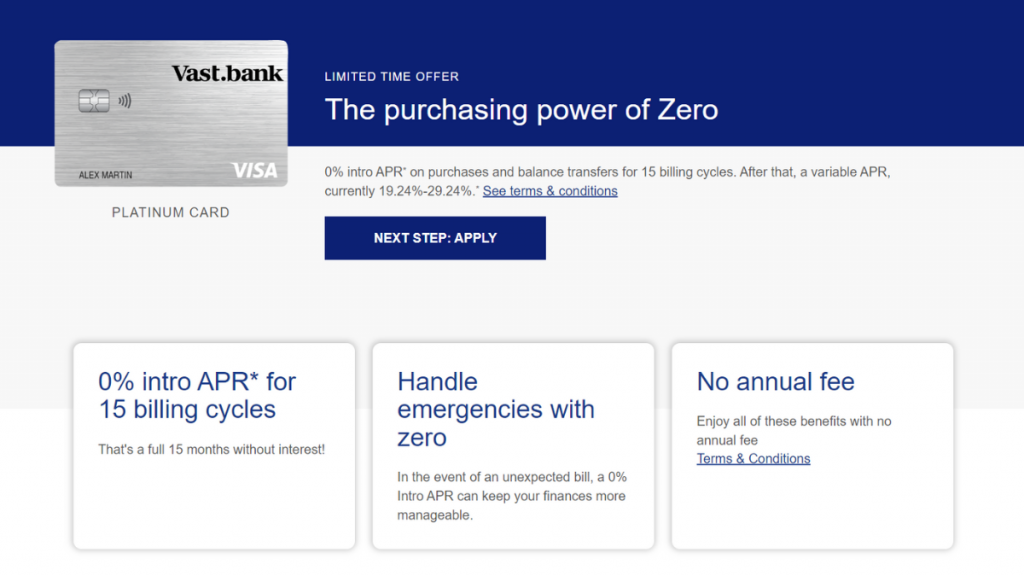

- Intro offer: Intro APR of 0% in the first 15 billing cycles;

- Rewards: There is no reward program;

- APRs: 19.24% – 29.24% variable after the intro period;

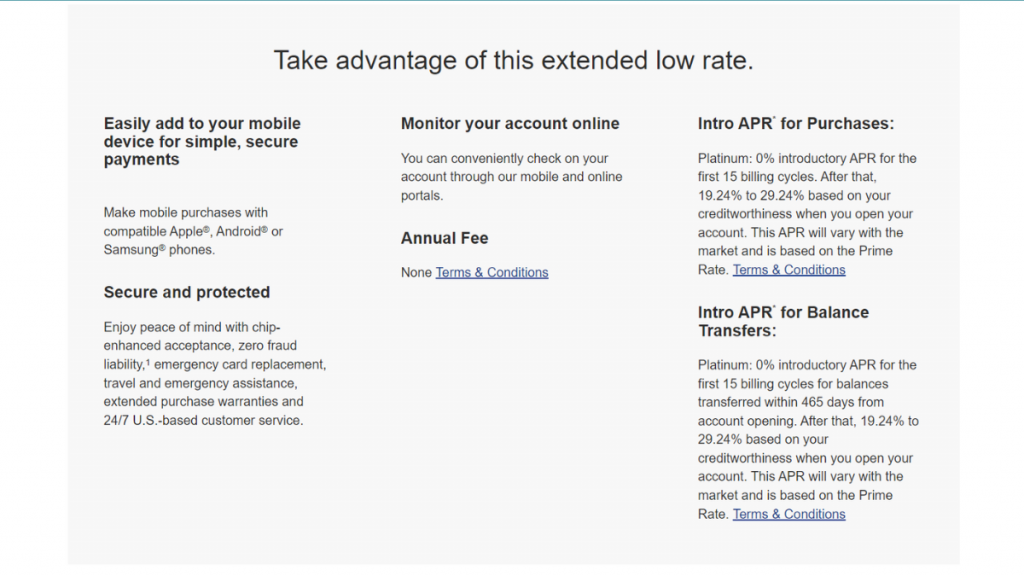

- Other Fees: This card charges a 3% fee (or $5 minimum) for cash advances and balance transfers. Plus, there’s a 3% fee on Foreign Transactions. Also, expect a fee of $41 on late payments.

Whether you’re a seasoned cardholder or considering your very first credit card, check out its features and benefits before you decide to apply for the Vast Visa® Platinum.

Vast Visa® Platinum Card: What can you expect?

The Vast Visa® Platinum Card is your ticket to financial freedom, and in this review, you see why this is the perfect option for you. With low rates and valuable benefits, it’s your trusted financial companion!

First, say goodbye to annual fees, as this card puts your financial interests first, ensuring you keep more of your hard-earned money. Besides, you have an intro offer of 0% APR in the first 15 billing cycles!

Whether you’re starting your credit journey or looking to boost your score, this card helps you build a stronger credit history with responsible use. This means you don’t need a high score to apply.

As you can see in this review, the Vast Visa® Platinum is not just an easy credit card to apply for but also a financial partner that puts your interests first. Prepare to have your financial life simplified!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Before applying for a credit card, it’s important to understand all of its features to be sure you’re making the right choice.

In this Vast Visa® Platinum Card review, we’ll weigh the advantages and disadvantages of this financial tool, from its no annual fees and low introductory APR to its limitations in terms of rewards and benefits.

Pros

One of the main positive features of the Vast Visa® Platinum Card is that you don’t even need a credit score history to apply. So, if you have poor credit scores and are in need of a financial tool, try this card!

Besides, new cardholders have an intro offer of 0% APR in the first 15 billing cycles. This will help you put your financial life in order and enjoy your shopping experience even more. Other pros for this card:

- No annual fee;

- Zero Fraud Liability;

- 24/7 cardmember service;

- Travel Assistance.

Cons

As you can tell by this review of the Vast Visa® Platinum, this card has no rewards program or cashback. Besides, after the 0% intro APR period, the variable is quite high, from 19.24% to 29.24%.

Other important drawbacks to consider before applying for this credit card include:

- Foreign transaction fee;

- No bonus or incentive for new cardholders;

- Fewer additional perks.

What are the eligibility requirements?

It’s actually quite easy to apply for the Vast Visa® Platinum Card and get approved, as mentioned before in this review.

Even if you have no credit history or even a poor credit score, you can be approved!

The minimum requirements for this card include being 18 years old or older, having an address within the U.S., and having a Social Security Number.

With that, you can try applying online by filling out the form.

Learn how to get the Vast Visa® Platinum Card

As you can see, the Vast Visa® Platinum Card is a great option for a starter card or even if you want to put your financial life in order. With simple eligibility criteria, this card is convenient and easy to get.

But, before you apply for this card, remember to carefully review all terms and conditions for the Vast Visa® Platinum. This way, you’ll ensure that the card aligns with your goals and needs.

Apply online

The first step is to visit the Vast Bank website. Then, find the “Personal” option on the main menu and click on “Credit Cards”. Choose “Proceed” on the pop-up warning to leave the website page.

When you see the list of credit cards available, scroll down until you find the Vast Visa® Platinum and click on “Learn more” to review it. Then, find the “Apply now” option and click on it.

You’ll be asked to provide personal and financial information, including your name, contact details, Social Security Number, income, and employment status. When you’re done, submit your application.

If your application is approved, you’ll receive your Vast Visa® Platinum Card by mail. Finally, all you have to do is activate the card following the instructions provided.

Apply using the app

First, download the official Vast Bank app from the Google Play Store or App Store. Then, log in to your bank account or create one if you’re new. You may need to have an account to apply for this card.

After that, navigate to the section related to credit cards or card services and review all the information about the Vast Visa® Platinum before you apply. When you’re done, tap on the “Apply now” option.

Then, fill out the credit card application form provided with all the personal and financial information required. After you’re finished, submit the application and wait for the bank to respond.

If your application is approved, you’ll receive your Vast Visa® Platinum Credit Card by mail. It’s that easy!

If, after this review, you’re still not sure the Vast Visa® Platinum Card is right for you, check out the BankAmericard® for Students! Even if you’re still young, this is a great way to build a strong credit history!

Also, with simple and straightforward features, this card can help you make tuition payments and build your financial stability! Plus, it has no annual fee and doesn’t require a high credit score for approval.

In addition, the BankAmericard® for Students credit card offers security features and an exclusive mobile app for easy access. Want to know more? Then check below to see the complete review!

How to apply for the BankAmericard® for Students

Learn how to easily and quickly apply for the BankAmericard® for Students Credit Card.

Trending Topics

See how to apply for the BMO CashBack Business Mastercard Credit Card

Discover how you can easily apply for the BMO CashBack Business Mastercard credit card and save money on your business purchases!

Keep Reading

iOS 16.1 is out, and it brought new features with it

Apple’s just released the new 16.1 iOS update and it comes with a series of new features, fixes and interesting tweaks. Read on for more!

Keep Reading

The top 10 greatest villains of all time!

Some people say Darth Vader is the greatest villain, but others might disagree. We'll look at the top ten greatest villains of all time!

Keep ReadingYou may also like

See how to apply for The Platinum Card® from American Express

Learn the ins and outs of The Platinum Card® from American Express application process and how you can easily request it online.

Keep Reading

Unconventional Christmas movies to watch this holiday season

Here are the most unconventional, but totally awesome and fun Christmas movies to watch this holiday season. Read on to learn more!

Keep Reading

Icons of Rock: the greatest rock biopics of all time

Find out who tops the list as we countdown our picks for the greatest rock biopics of all time. These are must-see movies for any music fan!

Keep Reading