SA

Credit cards: Find the perfect option for your financial needs!

Are you looking for a new credit card? Check out our tips on how to choose the best one for your needs, including factors to consider and questions to ask! (Credit Card FNB, Nedbank and more!)

Advertisement

Are you in the market for a new credit card? If so, you know that with all the options out there it can be hard to make up your mind. Because of this, it’s essential to consider all your financial needs when you want to choose the right credit card is right for you.

In this handy guide, we’ll take a look at what type of credit cards are available. We’ll explain which features and benefits to consider when you choose a new credit card. Plus, we’ll provide some tips on how to apply and use them responsibly. So read on to learn more!

Learn how to choose a credit card that makes sense for your situation

If you’re looking for ways to choose a credit card that makes sense for your situation, there are a few things you should consider. The first is what type of rewards and benefits the card offers.

Do you want cash back or points? Or maybe some exclusive travel perks? Knowing what kind of reward structure works best for you can help narrow down your choices.

Another important factor to consider is the interest rate, as well as any fees associated with the card. It’s also a good idea to choose a card that fits in with your lifestyle and spending habits.

If you travel frequently, a card with miles might be right for you. Finally, be sure to choose a credit card from a reputable issuer with a good customer service record. Taking the time to choose the right credit card for your needs can help you get the most out of it in the long run.

You will be redirected to another website

What types of cards are available in South Africa?

There are so many different types of credit cards available for you to choose from, that it can sometimes be hard to decide which one is the best fit for your lifestyle!

From premium rewards cards to student-focused cards, here’s a breakdown of all the different types of credit cards available in South Africa so you can choose your next credit card responsibly.

Rewards Credit Cards

Rewards credit cards offer great perks and benefits, such as cashback or points for every rand spent.

These rewards can be redeemed on a variety of products and services like flights, gifts and more. Premium rewards cards are ideal if you’re looking to maximise your spending power. You’ll be able to choose a rewards credit card if you have a good credit record.

Low-Interest Credit Cards

Low-interest credit cards are designed to help you manage your finances better, by offering a low interest rate when compared with regular credit cards. People usually choose this type of credit card to improve their scores.

This is great for people who carry a balance and need some extra time to pay off their debt without incurring too much interest.

Business Credit Cards

A business credit card is an invaluable resource for entrepreneurs and small business owners. Not only does it allow you to manage your finances more effectively, but it also gives you access to a host of benefits and rewards.

You can enjoy exclusive discounts on everyday purchases, receive cash back or travel rewards, or even get access to financing for larger investments. If you are looking to improve your business’ finances, you should definitely choose a business credit card.

Student Credit Cards

Student credit cards are specifically designed for students, to help them manage their finances and build up a good credit rating. These cards usually offer special discounts, rewards and other benefits that can be used by students.

You can only choose a student credit card if you’re over the age of 18 and enrolled in college.

Tips to choose the best credit card for you in 2023

2023 is already here, and there are plenty of exciting opportunities for South Africans to take full advantage of their credit card options.

The good news is that choosing the best credit card for you doesn’t have to be a daunting task – by following these simple tips, you can rest assured knowing you’ll find the best fit for your lifestyle.

Check your credit score

Understanding your financial situation and being aware of what lenders require from applicants can be invaluable when making an informed decision. You’ll be better equipped to choose the best credit card for your needs once you have that data.

Take a look at your current score – there are plenty of online tools available to help you know where you stand in terms of creditworthiness. Is it good? Then you’re starting off with a distinct advantage!

Consider your spending habits

Carefully examine where and how you use your cash and cards to determine what kind of credit card would fit you best. Do you spend more on groceries, petrol, or dining out? Consider a rewards program that offers bonus points for these purchases.

Compare the annual fees and interest rates

If you’re looking to choose a long term credit card, make sure to read the fine print of each agreement and compare the annual fees and interest rates. Remember that it’s not always about finding the lowest fee or rate!

Choose a credit card that is accepted everywhere

Some cards may only be accepted at certain merchants, so consider how often you’ll be using your card when shopping around. Choose a credit card that has a wider acceptance, including overseas.

Choose a credit card with added perks and benefits

Many credit cards come with additional rewards such as airline miles, cash back, or even insurance coverage. Pay close attention to the details of any offers that catch your eye! Make sure you choose a credit card that offers benefits for what you spend most money on.

Choose a credit card with good security features

Look for a credit card that offers advanced security features such as biometric authentication or at least chip-and-PIN technology. This will help you stay safe and secure when using your card.

Read the terms and conditions

Before you choose your new credit card, make sure you read the terms and conditions carefully. This will help you understand any hidden fees or restrictions that may be in place.

Choose your personal loan: find the best lenders in South Africa!

Taking out a personal loan can be a great way to increase your purchasing power and finance a range of expenses. Whether you’re looking for funds to purchase something large, cover educational costs or make home improvements, finding the right lender is critical.

With so many lenders offering loans in South Africa, it’s important to shop around for the best deal before settling on one. In the following link, we’ll go through all the details you need to know about choosing your personal loan.

From comparing rates and fees and understanding repayment terms to finding reliable lenders in South Africa that offer competitive interest rates. Read on for helpful advice and tips on how to get the best possible deal.

Choose your personal loan: Find the best lenders!

Choosing a personal loan can be tricky. That's why we've done the hard work for you and prepared this helpful guide.

Trending Topics

Avo Africa review: All Your Lifestyle Needs in One App

From online grocery delivery and payment solutions, discover why Avo is the perfect lifestyle companion in this Avo Africa review!

Keep Reading

See how to apply for the FNB Premier Credit Card

Learn about this top-of-the-line credit card and how to apply for the FNB Premier Credit Card today. Enjoy its rewards, benefits, and perks!

Keep Reading

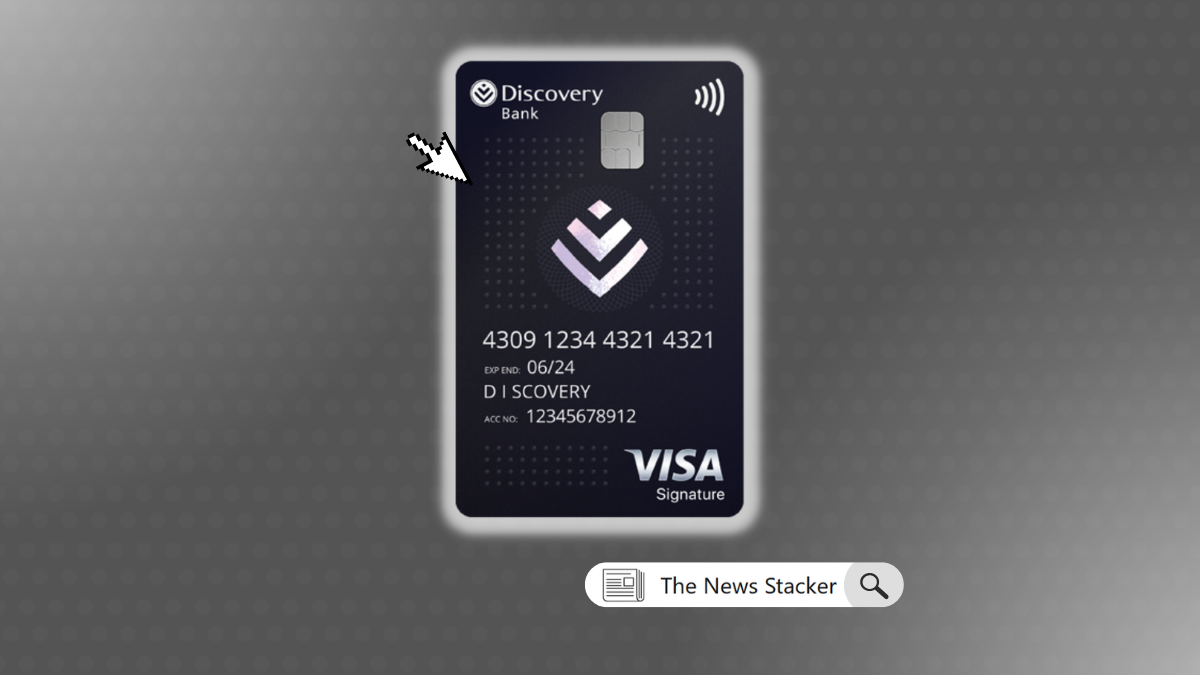

See how to apply for the Discovery Bank Black Card

Are you seeking a credit card with high benefits and rewards? Discover everything you need to know to apply for The Discovery Bank Black Card.

Keep ReadingYou may also like

Absa Student Credit Card review

Are you a student looking for a card? This review of the Absa Student Credit Card will help you decide if it's the right option for you.

Keep Reading

FNB Aspire Credit Card review

Are you looking for a credit card that offers you value and rewards? Then check out our in-depth FNB Aspire Credit Card review.

Keep Reading

Up to R300,000: Apply for a Wesbank Personal Loans now

Don't let the fear of applying for a loan hinder you from achieving your financial goals. Find out how to apply for Wesbank Personal Loans!

Keep Reading