Tips

Self-employment tax: What it is and how it works

Freelancers and independent contractors, read this post to learn everything you need to know about self-employment tax.

Advertisement

Discover all there is to know about self-employment tax

Self-employment tax, or SE Tax, is an important yet complicated topic for self-employed people. If you’re a freelancer or independent contractor, it’s essential to understand how this type of taxation works and how it affects your bottom line.

In this post, we’ll cover all the basics of self-employment tax. What is it, who has to pay it, and where does the money go?

Get ready to dive into the details and learn everything you need to know about one of the biggest financial burdens (and greatest rewards) of running your own business.

The basics of self-employment tax: everything you need to know

If you’re self-employed, you may wonder just how taxation works for your business.

Taxes are difficult to maneuver at the best of times, so it can be especially daunting when considering filing taxes as a freelancer or self-employed worker.

It’s important to know what kind of taxes you must pay and how they work. Sp you to stay compliant with tax laws and avoid headaches down the line.

In this blog post, we’ll explore what self-employment tax. Also, who has to pay it, and how it affects your bottom line. Keep reading to discover all there is to know about this topic!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What is self-employment tax?

Self-employment tax is one of those phrases that may be unfamiliar to some of us. But it’s still important to understand what self-employment tax really means.

Self-employment tax is essentially the self-employed individual’s contribution to Social Security and Medicare, usually split between employer and employee, which would otherwise go straight from salary.

These taxes help self-employed individuals to qualify for Social Security benefits.

So when completing your taxes, make sure you account for self-employment taxes. So you don’t miss out on key exemptions or benefits as a self-employed individual.

How does it work?

According to the IRS, you must pay self-employment tax if your net earnings are at least $400.

Your self-employment net earnings are based on how much money you make after deducting ordinary and necessary trade or business expenses from your gross income.

Once you’ve calculated 92.35% of your total earnings, you can use the tax rate to determine how much you owe in taxes.

Remember this information; it could save you some serious cash in the long run!

Self-employment tax rate

Figuring out self-employment tax rates can be a bit confusing. But it’s important to know exactly how much tax you owe.

The self-employment tax rate is typically 15.3%, which is split into Social Security and Medicare taxes.

For Social Security taxes, self-employed workers are taxed 12.4% up to the first $160,200 of net self-employment income. Double what employers and employees pay.

With Medicare taxes, self-employed workers are taxed at 2.9% on their net earnings. So be sure to account for that when calculating your tax rate!

How to file your self-employment taxes

Planning and filing self-employment taxes can seem daunting, but with the right information, it doesn’t have to be!

Self-employed individuals must complete Schedule C (Form 1040), Profit or Loss from Business. To report net income and associated business expenses.

Additionally, you’ll also be required to fill out Schedule SE (Form 1040), which helps self-employed workers calculate self-employment taxes.

As self-employed individuals aren’t subject to tax withholding like typical employees, the IRS requires self-employed people to submit estimated taxes quarterly.

So ensuring you meet all self-employment and income tax obligations is very important!

Is it possible to avoid self-employment tax?

It may not be possible to avoid self-employment taxes completely. But there are some ways to lower the amount you owe potentially.

Qualifying tax deductions can help reduce self-employment taxes and save you money in income taxes.

It’s even possible to deduct 50% of the 7.65% employer-equivalent tax from your income tax bill. Effectively saving money owed on self-employment income.

The CARES Act employer portion deferment.

Are you one of the self-employed who took advantage of the ability to defer payment of your self-employment tax as part of the CARES Act?

If so, unfortunately, that deferment had a shelf life and expired on December 31, 2022. The CARES Act was an incredible and much-needed economic relief package for self-employed individuals.

It offered some immediate hope for those in need. But it’s important to remember that the measures included did have an expiration date. No matter how many extensions Congress considered throughout 2020.

Overall, understanding the self-employment tax can benefit freelancers and self-employed workers in the long run.

Not only does it save time when filing taxes. But knowing this information also helps maximize finances when it comes to setting aside money for income taxes.

For those considering freelancing or self-employment, cautiously preparing yourself on personal taxation is one of the most important steps to success in this field.

Therefore learning what you need to know about the self-employment tax can make all the difference. Ensuring your financial stability and future goals!

How to track your IRS tax refund

Are you wondering where your IRS tax refund is? We know that waiting for a refund check can be an anxious experience.

To put your mind at ease, we will show you how to track your IRS tax refund quickly and easily. By leveraging the advantages of modern technology and tracking tools, you can get up-to-date information on the status of your return almost instantaneously!

In the next blog post, we’ll guide you through the different methods available. So that you can decide which one best suits your needs. Keep on reading!

How to track your IRS tax refund

Worried about your refund? Don't be. Stay up-to-date on your return status with these easy steps.

Trending Topics

Learn where you can watch the 2022 FIFA World Cup

The 2022 FIFA World Cup will begin on November 20, and it’s the biggest sporting event in the world. Here’s how you can watch it.

Keep Reading

10 Foods That Can Negatively Affect Your Health

Learn about the 10 foods that can affect your health. From processed snacks to fried foods, these are the foods you should avoid!

Keep Reading

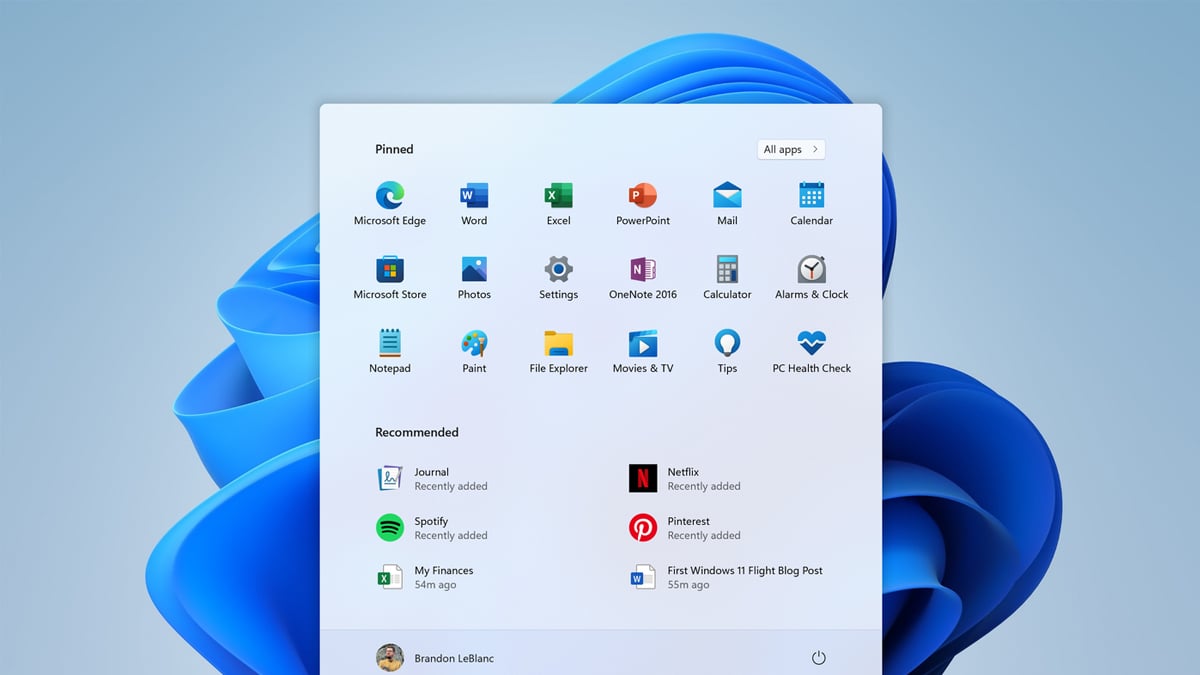

Change these Windows 11 settings to optimize your PC

Learn how to change a few Windows 11 default settings to optimize your computer’s potential, improve your security, and much more!

Keep ReadingYou may also like

The richest man in Canada: find out who is the man in this desired position

Canada is a wealthy country, and so is the richest man who lives there. See who is making more money in Canada right now.

Keep Reading

See how to apply for the LightStream Personal Loan

Apply for a LightStream Personal Loan and get the funds you need with the best rates in the market and exceptional terms!

Keep Reading

How to choose your credit card: Find the best option for your financial habits!

Are you in the market for a new card? Check this guide first to learn how to choose your next credit card to perfectly suit your lifestyle.

Keep Reading