Reviews (AU)

ANZ Personal Loans Review: Get the Funds You Need!

Whether you need stability with a Fixed Rate Loan or flexibility with a Variable Rate Loan, ANZ has you covered. Make dreams a reality and unlock financial possibilities! Learn more!

Advertisement

With personalized rates, choose between stability or flexibility to suit your financial goals!

Although the ANZ Personal Loans offer unique financial opportunities, it’s essential to review the benefits before compromising your credit. So, explore some of the features this loan has to offer!

From personalized interest rates and same-day cash access to enticing cashback incentives, ANZ Personal Loans provide a tapestry of opportunities for those looking to realize their dreams!

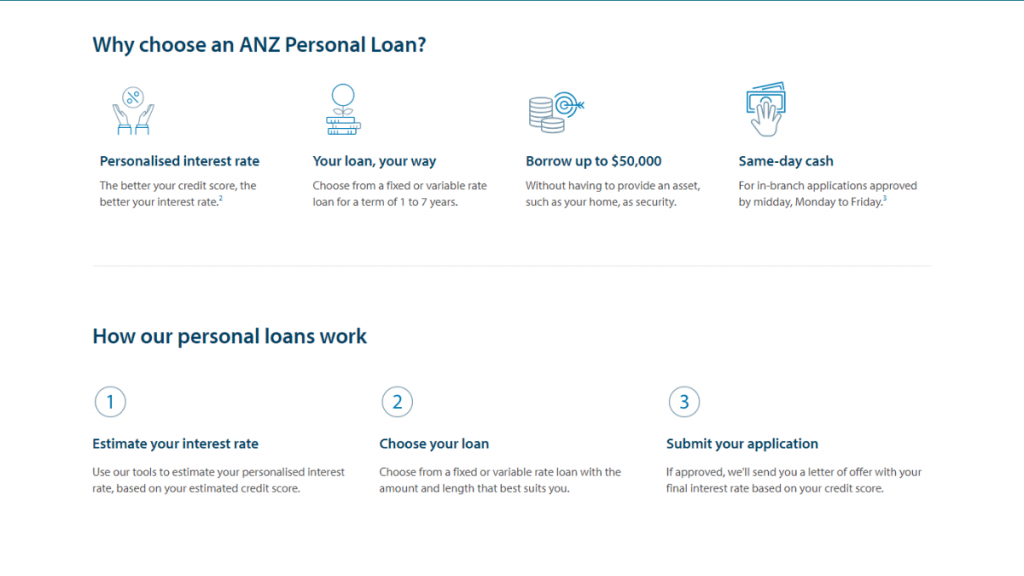

- APR: The better your credit score, the more favorable your APR.

- Loan Purpose: ANZ Personal Loans are versatile, accommodating a myriad of purposes.

- Loan Amount: With ANZ Personal Loans, you can borrow amounts ranging from $5,000 to a substantial $50,000.

- Credit Needed: While a better score can unlock more favorable terms, ANZ Personal Loans cater to a spectrum of profiles. This makes them accessible to a broad range of borrowers.

- Terms: The terms for ANZ Personal Loans provide further flexibility, with loan durations ranging from 1 to 7 years.

- Origination fee: ANZ imposes a loan approval fee of $150, ensuring a transparent understanding of the associated costs.

- Late Fee: ANZ Personal Loans come with a $20 late payment fee for repayments that are 5 days or more overdue.

- Early Payoff Penalty: For borrowers opting for Fixed Rate Loans, it’s essential to be aware of potential Early Repayment Costs.

ANZ Personal Loans: what can you expect?

When you choose ANZ Personal Loans, you’re entering a realm of financial possibilities to review carefully. Then you can understand if they meet your unique needs. Are you ready to start your experience?

The hallmark of ANZ’s offering lies in its commitment to personalization. ANZ understands that financial needs are as diverse as the individuals seeking assistance.

So, expect a loan range that accommodates both the modest and the substantial, with amounts stretching from $5,000 to a generous $50,000.

Moreover, as you navigate through the application process, relish the power to choose between Fixed Rate Loans and Variable Rate Loans.

You will be redirected to another website

Fixed Rate Loans

ANZ Fixed Rate Loans offer borrowers a pathway marked by financial stability and predictability.

When you opt for a Fixed Rate Loan, you are securing an interest rate that remains constant throughout the agreed-upon term, shielding you from the potential volatility of market rate fluctuations.

While Fixed Rate Loans offer a shield against rising interest rates, they come with the potential for Early Repayment Costs if you decide to settle your loan ahead of schedule.

Variable Rate Loans

Another type of ANZ Personal Loans important to review is the Variable Rate Loans. This presents a dynamic and flexible approach to personal financing.

Unlike their fixed-rate counterparts, these loans come with interest rates that may vary during the loan term, responding to fluctuations in the market.

The primary advantage lies in the borrower’s ability to make early or extra repayments without incurring additional costs, providing unparalleled flexibility in managing one’s financial commitments.

While this flexibility empowers borrowers, it’s crucial to note that the interest rate and monthly repayments may increase or decrease during the loan term, necessitating a strategic approach to financial planning.

Do the pros outweigh the cons?

So, it’s time to have a clear understanding of the terrain ahead and review the advantages and drawbacks of the ANZ Personal Loans.

Equip yourself with the knowledge needed to make informed decisions!

Pros

- Personalized interest rates;

- Convenience of same-day cash for in-branch applications approved by midday;

- Loan amount flexibility;

- Generous cashback incentive;

- Freedom to choose between Fixed Rate Loans and Variable Rate Loans;

- No collateral requirement.

Cons

- Loan approval fee;

- Loan administration charge;

- Late payment fee if your repayments are 5 days or more overdue;

- Early Repayment Costs for Fixed Rate Loans;

- Borrowers should be mindful of associated origination fees.

What are the eligibility requirements?

To be eligible for ANZ Personal Loans, applicants typically need to be at least 18 years old, Australian or New Zealand residents, and demonstrate a stable source of income, meeting a minimum income threshold.

Besides, a positive credit history is advantageous for favorable interest rates, and employment status, as well as debt-to-income ratio, are assessed to ensure financial stability.

Learn how to request the ANZ Personal Loans

So, embarking on your financial journey with ANZ Personal Loans is just a few clicks away, and you can review it now! Get ready to get the financial support you need today!

Learn how to request online

The online application process provides a convenient and straightforward way to access your funds as quickly as possible. Find out!

- Access the website: Firstly, access the ANZ website and click on the “Personal” tab on the main menu. Then, select “Personal loans”.

- Online application: Review the information available on the ANZ Personal Loans and choose between Fixed Rate or Variable Rate. Then, click to apply. You’ll need to create an account if you’re a new user or login if you already have an existing ANZ account.

- Complete the form: Fill out the online application form with accurate and up-to-date information, such as details about your personal information, employment, and income. Moreover, upload the necessary supporting documents as outlined in the application.

- Submit and wait for approval: After submission, ANZ will review your application. Upon approval, you can accept the offer, and the funds will be disbursed to your nominated account.

What about another recommendation: Quick Cash Loans!

If speed is of the essence and you need swift financial solutions, Quick Cash Loans may be the alternative you’re searching for. This opportunity is for those who need immediate access to funds.

Without the extensive application processes associated with traditional loans, Quick Cash may be a great alternative to review instead of ANZ Personal Loans.

Explore your options to make an informed decision!

See how to apply for Quick Cash Loans

Are you looking for an instant financial solution tailored to your budget? Apply for Quick Cash Loans today and borrow the money you need.

Trending Topics

Quick Cash Loans review: Quick & Easy Access to the Funds You Need Online

Unexpected expenses can pop up out of nowhere. Get informed and decide if Quick Cash Loans are the right online lending option - up to $5K!

Keep Reading

ANZ Rewards Platinum Credit Card: Your Ticket to Exclusive Perks!

Explore the ANZ Rewards Platinum Credit Card! With a generous rewards program, exclusive travel perks, and more!

Keep Reading

The American Express Essential® Credit Card review

Get the lowdown on The American Express Essential® Credit Card and find out what makes it stand out from other cards in the market.

Keep ReadingYou may also like

How to apply for the Low Rate Credit Card from American Express®

Find out all the features and benefits when you apply for The Low Rate Credit Card from American Express® today! Read on!

Keep Reading

Qantas Premier Platinum Credit Card review: Enjoy Premium Travel Benefits

Discover all the perks and potential savings of the Qantas Premier Platinum Credit Card in our review. Get a full breakdown here.

Keep Reading

Citi Rewards Card review: Earn points for travel!

Read our Citi Rewards Card review and uncover all the details about its benefits, drawbacks, rates, and fees!

Keep Reading